Saturday Strategy

Mortgage FAQ's, did you knows and much more...

New Build Financing Insights

In the current market, some new build lenders offer substantial credits to lower interest rates. While this may seem appealing, it's crucial to evaluate the long-term implications. We recently reviewed a client's loan estimate with nearly $40,000 in credits to reduce interest rates, but the home's price was only $380,000. Essentially, they were paying almost 10% more for the house upfront. Yikes! Check out this weeks Saturday Strategy Video

Check this out... the Annual Percentage Rate (APR) exists to reflect the true interest rate. In some cases, it can be deceptively high, around 11 to 13%+, due to excessive upfront costs.

Don't rush into decisions. The lowest rate with the wrong strategy can cost you thousands.

Should You Sell Your House As-Is or Make Repairs?

Should You Sell Your House As-Is or Make Repairs? A recent study from the National Association of Realtors (NAR) shows most sellers (61%) completed at least minor repairs when selling their house. But sometimes life gets in the way and that’s just not possible. Maybe that’s why, 39% of sellers chose to sell as-is instead (see chart below): If you’re feeling stressed because…

Renting vs. Buying: The Net Worth Gap You Need To See

Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth. Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finances (SCF). It shows how much wealth homeowners and renters have – and the difference is significant. On…

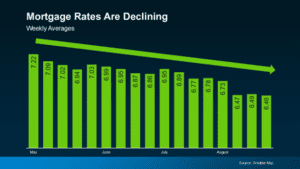

Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

If you’ve been keeping an eye on the housing market the last few years, you likely already know how much the mortgage rates have significantly impacted the industry. Many people (maybe yourself included) have found it extremely challenging to afford jumping into the market. However, recent developments offer some encouraging news—mortgage rates have begun to…

Understanding Mortgage Trigger Leads: A Guide for Homebuyers

Starting your journey to secure a mortgage can unexpectedly open the floodgates to calls, emails, and letters from various mortgage lenders. This overwhelming influx is often due to something called “mortgage trigger leads.” If it feels like your personal information is suddenly in high demand, you’re not alone. Many homebuyers find this practice intrusive. We’re…

7 ROUTINES TO MAKE YOUR DAYS MORE PRODUCTIVE

Follow a Regular Sleep Schedule. Getting a good night’s sleep is the first step to being more productive and accomplishing more in the day. Experts say waking up at the same time each day supports healthier sleep. Do Some Morning Tasks the Night Before. There are lots of little things to do in the morning before you…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!