Kevin Brierton - Branch Manager CLA, CMPS, NMLS 599873

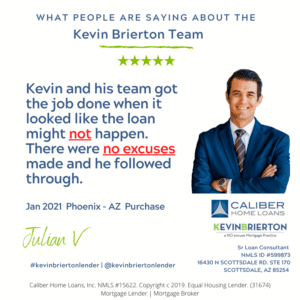

Your No Excuse Lender

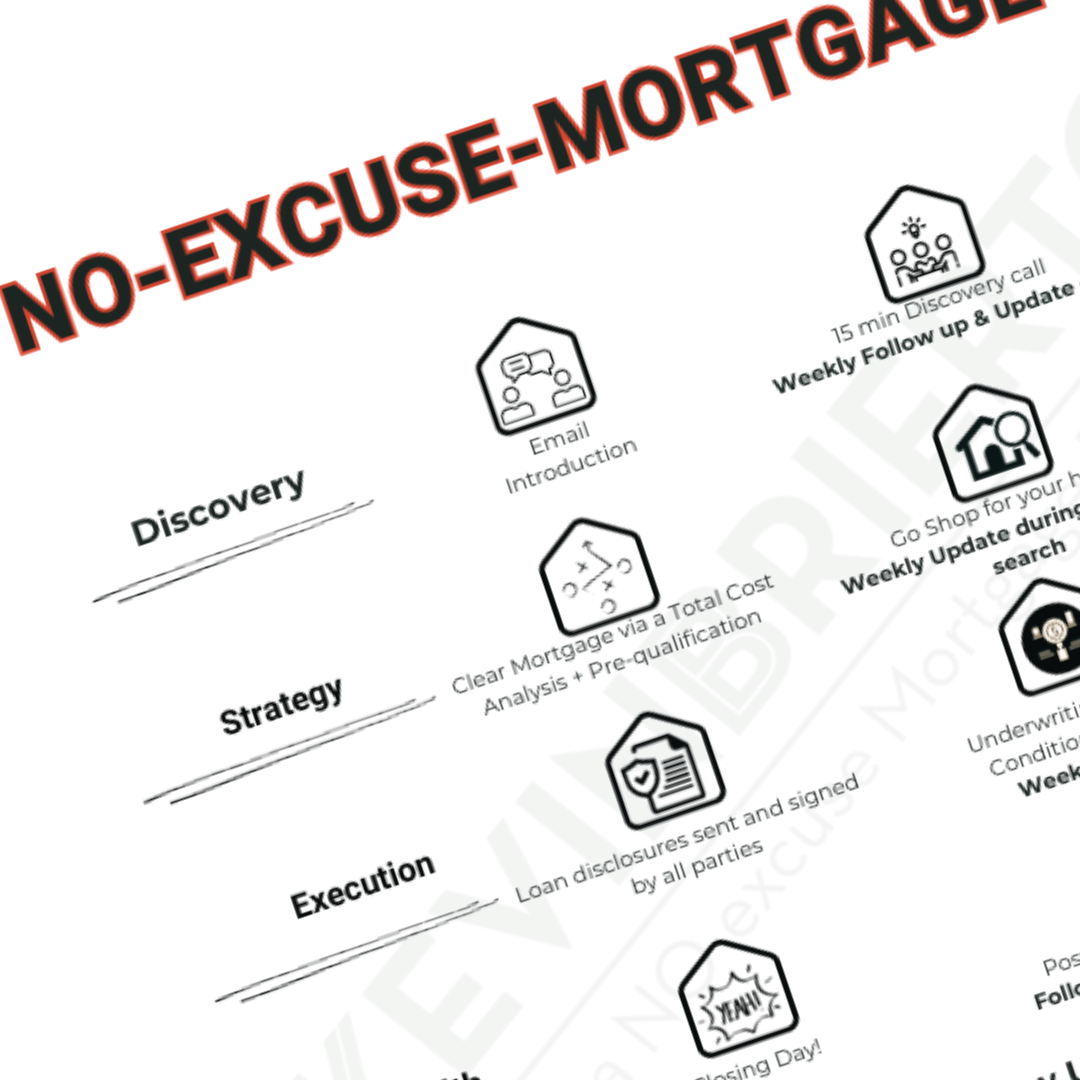

As YOUR NO EXCUSE LENDER, we provide clear communication, great follow-up, and on-time closings—no excuses. Our mission is to empower families and partners with a more confident mortgage experience. We’re not just here for the pre-approval and loan process; we’re committed to guiding our clients for the next 30 years, helping them grow wealth through smart mortgage strategies

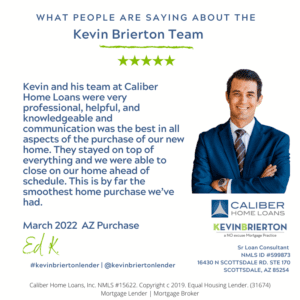

Clear Communication +

Great Follow Up +

On Time Closings +

= No Excuses

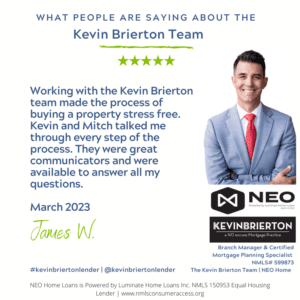

Kevin Brierton Team

The Kevin Brieton Team is committed to helping our clients grow their wealth and better understand their holistic financial situation, not just to give them debt.

Whether you need a Conventional loan, FHA loan, VA loan, Jumbo loan, Reverse Mortgage, Renovation loan, Home Equity Lines of Credit ( HELOC ) or a non QM Portfolio loan we are here to educate and serve you! Learn more about Loan Types

You Deserve More.... You Deserve a No Excuse Mortgage Process

Are you sick of excuses from lenders & banks? We are too!

We have built a No Excuse Mortgage Process backed by a No Excuse Promise designed to provide an process that provides clear communication, great follow up and on time closings with no excuses.

Families Not Files

Our loan files are titled FAMILIES rather than "files" because the team understands that a family trusts us behind all that paperwork.

We work towards getting these families a place to call home now and into the future. Kevin Brierton Team is here to create lifelong clients with our world-class services.

📌 FHA Loan FAQ: Do I Need a Manual Downgrade for a Decline in Self-Employment Income?

Question:My client has W-2 income and some side self-employment income that declined by more than 20% this year. We’re not using that income to qualify — do I still need to downgrade to a manual underwrite? Answer:No — as long as the self-employment income is not used to qualify the borrower, a manual downgrade is…

Why Today’s Foreclosure Numbers Aren’t a Warning Sign

Why Today’s Foreclosure Numbers Aren’t a Warning Sign Tuesday April 29th, 2025 Foreclosures, Economy When it feels like the cost of just about everything is rising, it’s only natural to wonder what that means for the housing market. Some people are even questioning whether more homeowners will struggle to make their mortgage payments, ultimately leading to…

Do You Think the Housing Market’s About To Crash? Read This First

Lately, it feels like a lot of people have been asking the same question: “Is the housing market about to crash?” If you’ve been scrolling through social media or watching the news, you might have seen some pretty scary headlines yourself. That’s why it’s no surprise that, according to data from Clever Real Estate, 70% of Americans are…

Why Pre-Approval Is More Important Than Ever This Spring

Spring is here, and so is the busiest season in real estate. More buyers are out looking for homes, which means more competition for you. If you want to put yourself in the best position to buy, there’s one step you can’t afford to skip, and that’s getting pre-approved for a mortgage. Some buyers think they…

Exciting news! I’m officially a Certified Liability Advisor (CLA) through Borrow Smart University!

This certification deepens my expertise in strategic mortgage and liability management, allowing me to help clients and partners make smarter financial decisions—not just during the loan process, but for the next 30 years. As YOUR No Excuse Lender, I’m committed to providing clear communication, great follow-up, and on-time closings—no excuses. Now, with this added knowledge,…

Spring 2025 - Buyer And Seller Guides

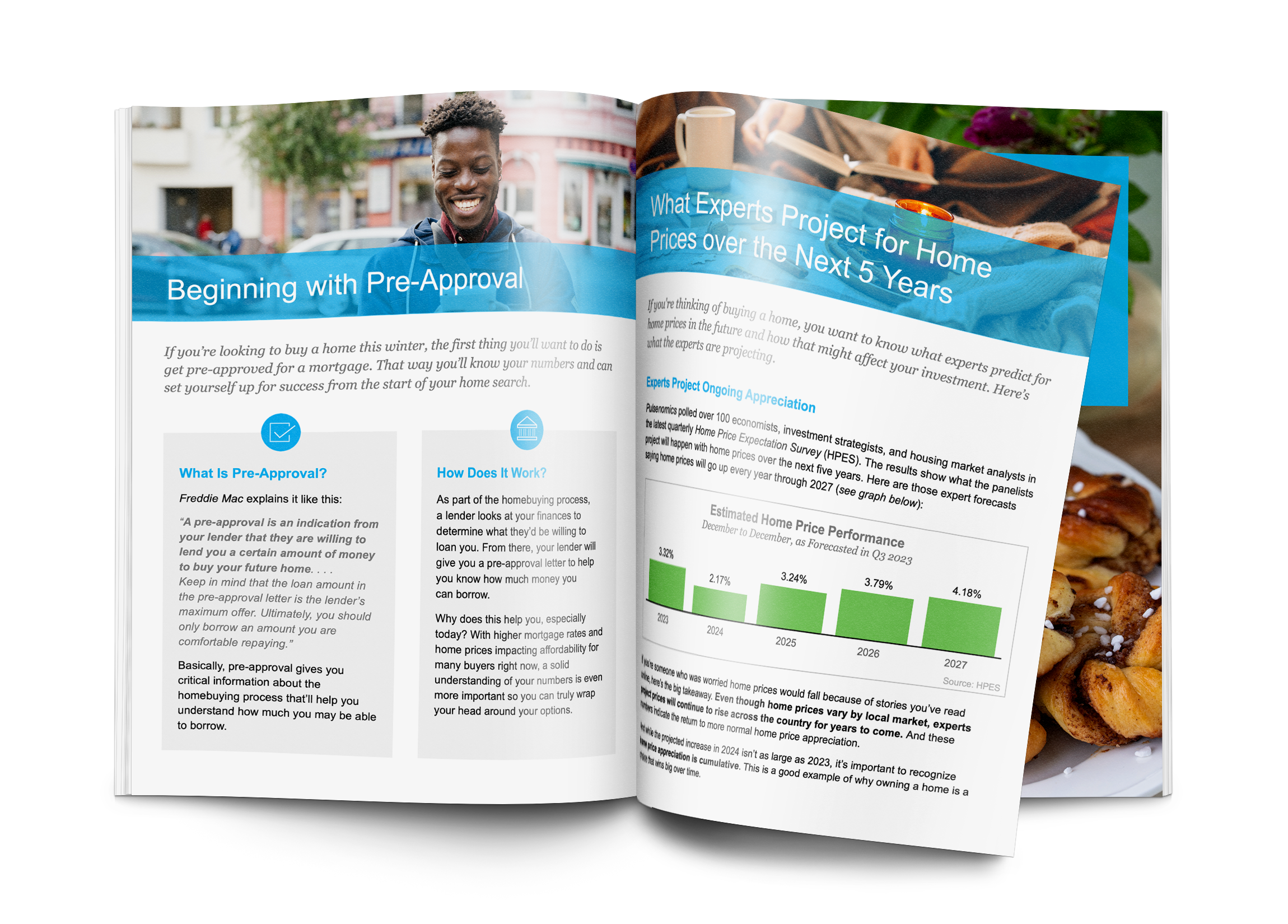

Thinking About Buying a Home?

The process of buying a home can be overwhelming at times, but you don’t need to go through it alone.

You may be wondering if now is a good time to buy a home…or if interest rates are projected to rise or fall. The free eGuide below will answer many of your questions and likely bring up a few things you didn’t even know you should consider when buying a home.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

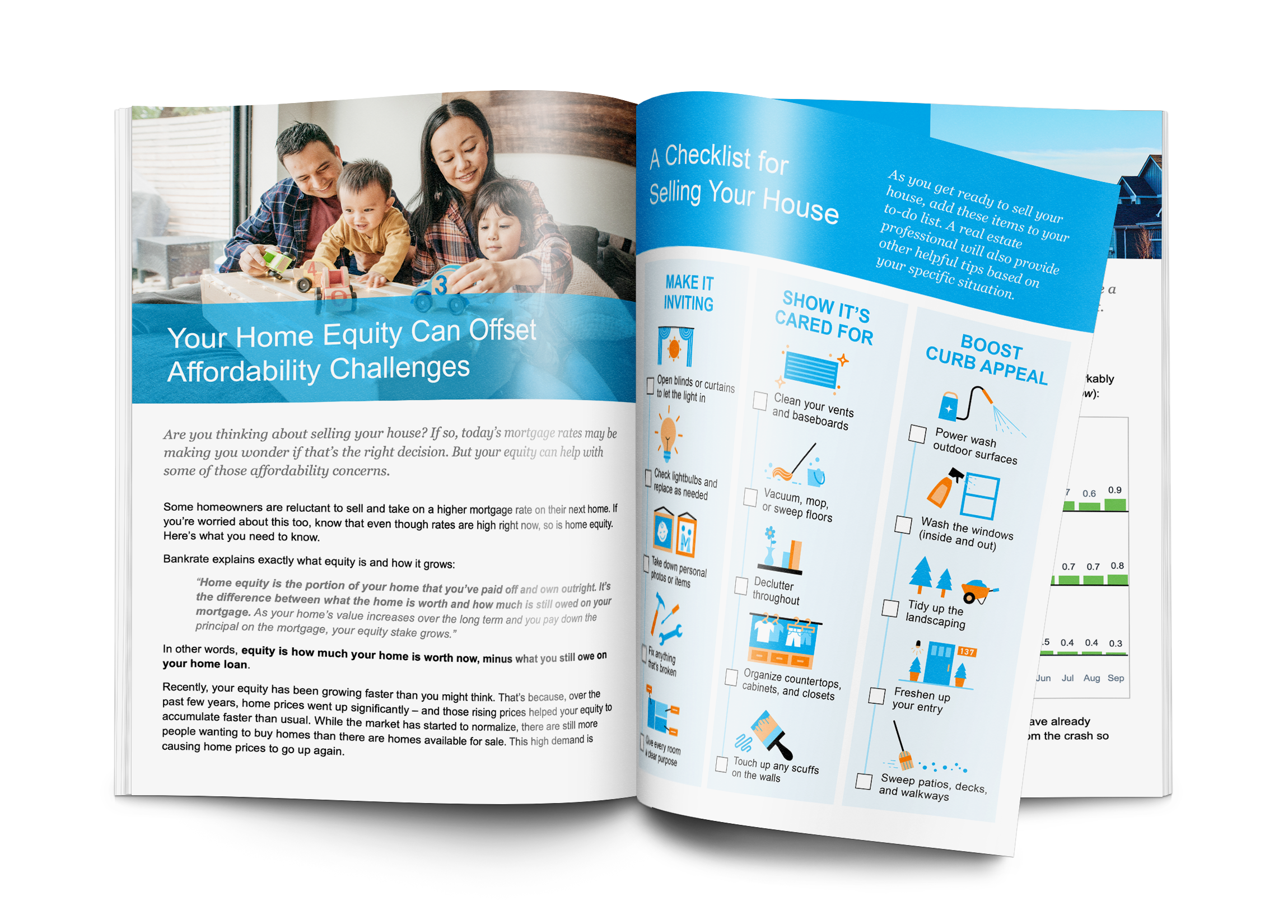

Thinking About Selling Your House Soon?

It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone.

You may be wondering if prices are projected to rise or fall…or how much competition you may be facing in your market. The free eGuide below will answer many of your questions and likely bring up a few things you haven’t even thought about yet.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

FREE Mortgage Payment Calculator & Mortgage Rate Updates