Kevin Brierton

Your No Excuse Lender

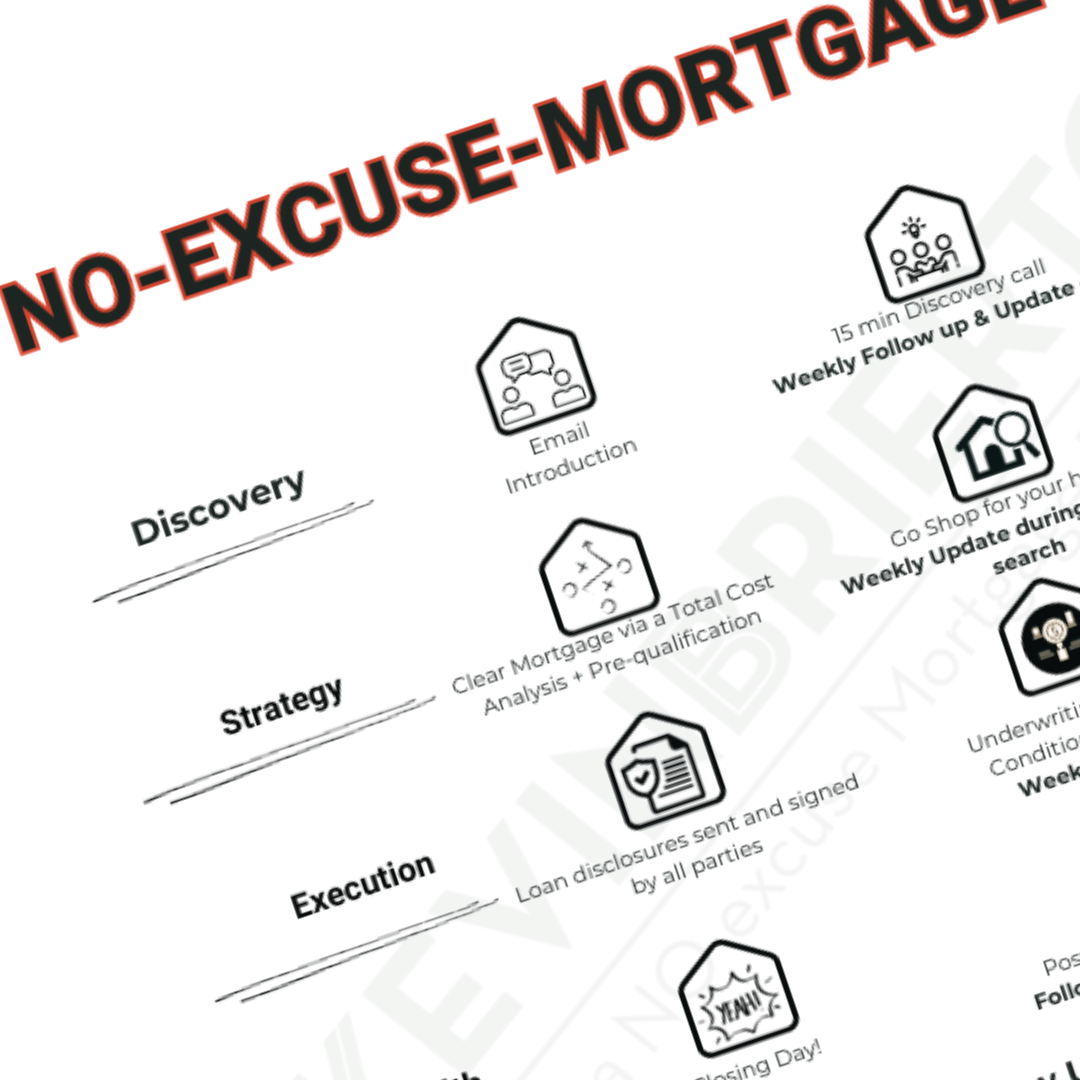

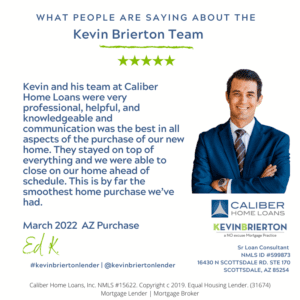

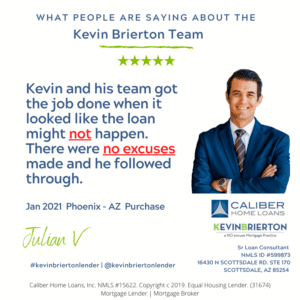

As YOUR NO EXCUSE LENDER we provide clear communication, great follow up & on time closings with no excuses to empower families & partners with an even more confident mortgage experience. We are committed to helping our clients not only during the pre-approval & loan process but also over the next 30 yrs.

Clear Communication +

Great Follow Up +

On Time Closings +

= No Excuses

NEO + Brierton

NEO Homes Loans represents THE NEW EXPECTATIONS that clients should have of their mortgage company.

NEO and The Kevin Brieton Team are both committed to helping our clients grow their wealth and better understand their holistic financial situation, not just to give them debt. Let me know if you would like more information about NEO Home Loans.

Whether you need a Conventional loan, FHA loan, VA loan, Jumbo loan, Reverse Mortgage, Renovation loan, Home Equity Lines of Credit ( HELOC ) or a non QM Portfolio loan we are here to educate and serve you! Learn more about Loan Types

You Deserve More.... You Deserve a No Excuse Mortgage Process

Are you sick of excuses from lenders & banks? We are too!

We have built a No Excuse Mortgage Process backed by a No Excuse Promise designed to provide an process that provides clear communication, great follow up and on time closings with no excuses.

What is CMPS?

We are Certified Mortgage Planning Specialists (CMPS)

We understand that we are helping families with perhaps the biggest debts of their lives. Our team agrees that its our professional responsibility is to help manage these debts to fit their short and long-term goals.

Families Not Files

Our loan files are titled FAMILIES rather than "files" because the team understands that a family trusts us behind all that paperwork.

We work towards getting these families a place to call home now and into the future. Kevin Brierton Team is here to create lifelong clients with our world-class services.

Will a Silver Tsunami Change the 2024 Housing Market?

Kevin Brierton – 1.29.2024 Have you ever heard the term “Silver Tsunami†and wondered what it’s all about? If so, that might be because there’s been a lot of talk about it online recently. Let’s dive into what it is and why it won’t drastically impact the housing market. What Does Silver Tsunami Mean? A recent article…

3 Must-Do’s When Selling Your House in 2024

Kevin Brierton – 1.22.2024 If one of the goals on your list is selling your house and making a move this year, you’re likely juggling a mix of excitement about what’s ahead and feeling a little sentimental about your current home. A great way to balance those emotions and make sure you’re confident in your decision is to keep…

Winter 2024 - Buyer And Seller Guides

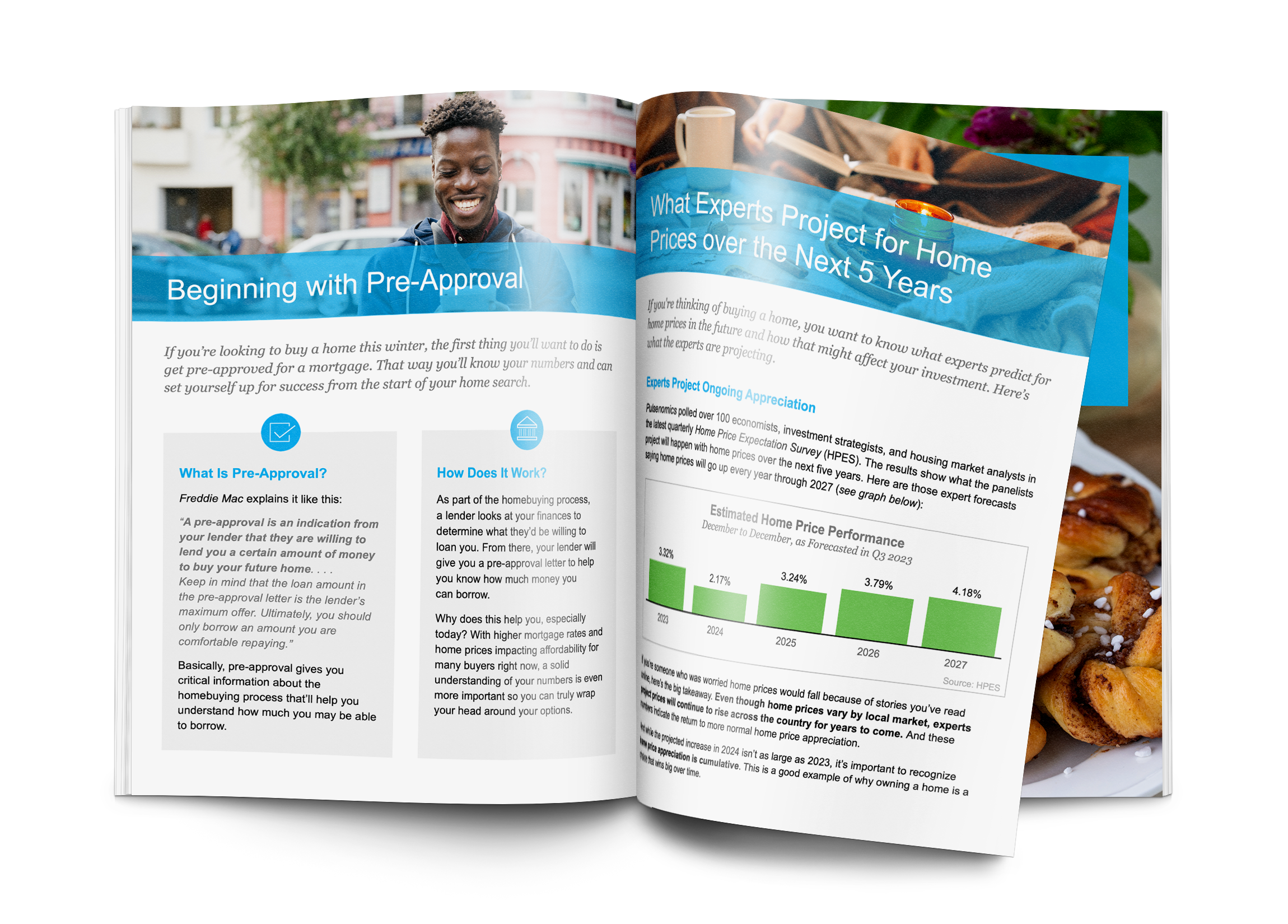

Thinking About Buying a Home?

The process of buying a home can be overwhelming at times, but you don’t need to go through it alone.

You may be wondering if now is a good time to buy a home…or if interest rates are projected to rise or fall. The free eGuide below will answer many of your questions and likely bring up a few things you didn’t even know you should consider when buying a home.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

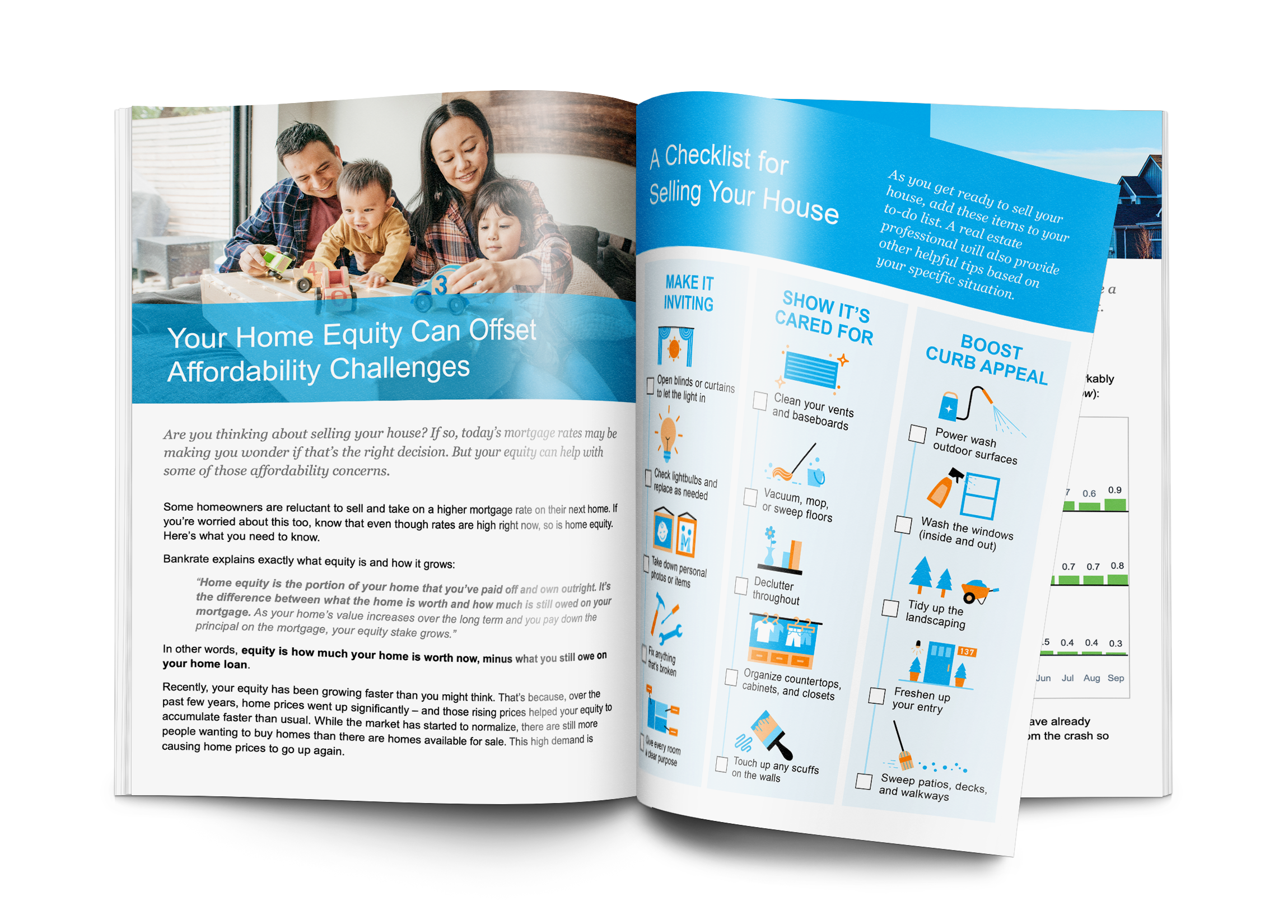

Thinking About Selling Your House Soon?

It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone.

You may be wondering if prices are projected to rise or fall…or how much competition you may be facing in your market. The free eGuide below will answer many of your questions and likely bring up a few things you haven’t even thought about yet.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

FREE Mortgage Payment Calculator & Mortgage Rate Updates

NEO represents THE NEW EXPECTATIONS that clients should have of their mortgage company. We are committed to helping our clients grow their wealth and better understand their holistic financial situation, not just to give them debt. Let me know if you would like more information about NEO Home Loans.

Contact us today!

Reach out to learn how we can help you and your family grow your wealth, make smart decisions, and save money.