Saturday Strategy

Mortgage FAQ's, did you knows and much more...

House Hackers! Buy a Multi Family with 5 % Down!

Fannie Mae just made a big announcement that's going to make it easier for families to buy homes. Let's break it down in simple terms.

Here is the announcement from Fannie Mea on Oct 4 2023

Lower Down Payments for Multifamily Homes

Before this update, if you wanted to buy a multifamily home (that's a place with more than one apartment), you had to put down a big down payment – either 15% or 25%, depending on the unit you were buying. But starting in November, things are changing.

The Big Change

Now, if you're buying a multifamily home to live in as your primary home, you can put down just 5% of the cost of the home. That's great news because it means you don't need as much money upfront to become a homeowner.

There Are Some Rules

But hold on, there are some rules you need to follow. First, you have to live in one of the units for at least 12 months. That means it has to be your main place to live. You can't just buy it and then rent it out right away.

Why This Matters

This is a big deal because it helps people own homes and build wealth. Imagine buying a place with multiple units, living in one for a year, and then renting out the others. It's a smart way to invest in your future.

So, if you know someone who dreams of owning a multifamily home, share this news with them. It's a fantastic opportunity to make homeownership more affordable.

Have a fantastic weekend, everyone!

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770.

Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

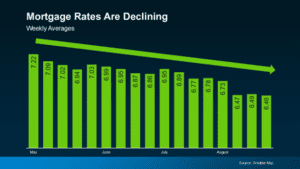

If you’ve been keeping an eye on the housing market the last few years, you likely already know how much the mortgage rates have significantly impacted the industry. Many people (maybe yourself included) have found it extremely challenging to afford jumping into the market. However, recent developments offer some encouraging news—mortgage rates have begun to…

Understanding Mortgage Trigger Leads: A Guide for Homebuyers

Starting your journey to secure a mortgage can unexpectedly open the floodgates to calls, emails, and letters from various mortgage lenders. This overwhelming influx is often due to something called “mortgage trigger leads.” If it feels like your personal information is suddenly in high demand, you’re not alone. Many homebuyers find this practice intrusive. We’re…

7 ROUTINES TO MAKE YOUR DAYS MORE PRODUCTIVE

Follow a Regular Sleep Schedule. Getting a good night’s sleep is the first step to being more productive and accomplishing more in the day. Experts say waking up at the same time each day supports healthier sleep. Do Some Morning Tasks the Night Before. There are lots of little things to do in the morning before you…

TWO WAYS TO BE MORE STRATEGIC WITH YOUR CREDIT

THESE 2 TIPS CAN IMPROVE YOUR CREDIT SCORE BY UP TO 25% BE STRATEGIC ABOUT YOUR LENGTH OF CREDIT HISTORY 1 – Your length of credit history looks at how long your accounts have been opened. This has a 15% impact on your score. The longer your accounts have been opened, the higher your score…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!