Kevin Brierton - Branch Manager CLA, CMPS, NMLS 599873

Your No Excuse Lender

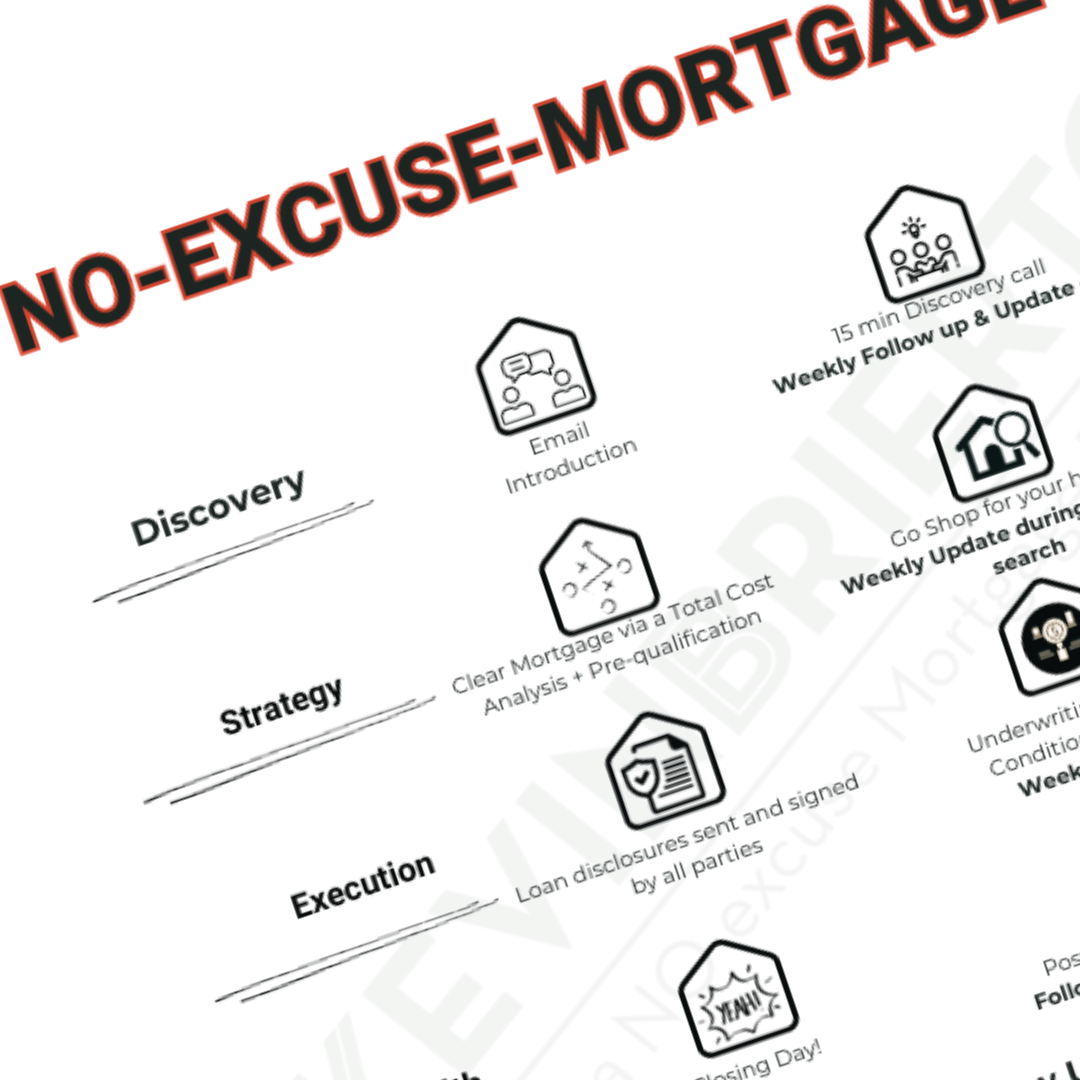

As YOUR NO EXCUSE LENDER, we provide clear communication, great follow-up, and on-time closings—no excuses. Our mission is to empower families and partners with a more confident mortgage experience. We’re not just here for the pre-approval and loan process; we’re committed to guiding our clients for the next 30 years, helping them grow wealth through smart mortgage strategies

Clear Communication +

Great Follow Up +

On Time Closings +

= No Excuses

Kevin Brierton Team

The Kevin Brieton Team is committed to helping our clients grow their wealth and better understand their holistic financial situation, not just to give them debt.

Whether you need a Conventional loan, FHA loan, VA loan, Jumbo loan, Reverse Mortgage, Renovation loan, Home Equity Lines of Credit ( HELOC ) or a non QM Portfolio loan we are here to educate and serve you! Learn more about Loan Types

You Deserve More.... You Deserve a No Excuse Mortgage Process

Are you sick of excuses from lenders & banks? We are too!

We have built a No Excuse Mortgage Process backed by a No Excuse Promise designed to provide an process that provides clear communication, great follow up and on time closings with no excuses.

Families Not Files

Our loan files are titled FAMILIES rather than "files" because the team understands that a family trusts us behind all that paperwork.

We work towards getting these families a place to call home now and into the future. Kevin Brierton Team is here to create lifelong clients with our world-class services.

📈 Buyers Keep Coming: Purchase Apps Up 18% From Last Year 🏡

Buyers Keep Coming – Inside Lending Week of 5.19.25 QUOTE OF THE WEEK “Do not let what you cannot do interfere with what you can do.”—John Wooden, American basketball coach and player NATIONAL MARKET UPDATE The Mortgage Bankers Association reports homebuyers came out in strength for the second week in a row, pushing purchase mortgage…

Housing Market Forecasts for the Second Half of 2025

🏡 Housing Market Forecasts for the Second Half of 2025 As we enter the latter half of 2025, the housing market presents a mix of challenges and opportunities. Understanding the current trends can help buyers and sellers make informed decisions. 📉 Mortgage Rates: A Gradual Decline Mortgage rates have been a significant factor in the…

📌 FHA Loan FAQ: Do I Need a Manual Downgrade for a Decline in Self-Employment Income?

Question:My client has W-2 income and some side self-employment income that declined by more than 20% this year. We’re not using that income to qualify — do I still need to downgrade to a manual underwrite? Answer:No — as long as the self-employment income is not used to qualify the borrower, a manual downgrade is…

Don’t Let Student Loans Hold You Back from Homeownership

Wednesday May 14th, 2025 For Buyers, First-Time Buyers, Buying Tips Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you’re wondering: Having questions like these is normal, especially when you’re thinking about making such a big purchase.…

Why Buyers Are More Likely To Get Concessions Right Now

Tuesday May 13th, 2025 For Buyers, Buying Tips Especially in areas where inventory is rising, both homebuilders and sellers are sweetening the deal for buyers with things like paid closing costs, mortgage rate buy-downs, and more. In the industry, it’s called a concession or an incentive. What Are Concessions and Incentives? When a seller or builder…

Home Projects That Boost Value

Monday May 12th, 2025 For Sellers, Equity, Selling Tips Whether you’re planning to move soon or not, it’s smart to be strategic about which home projects you take on. Your time, energy, and money matter – and not all upgrades offer the payoff you might expect. As U.S. News Real Estate explains: “. . . not every home renovation…

Housing Market Forecasts for the Second Half of the Year

Thursday May 8th, 2025 Mortgage Rates, Forecasts From rising home prices to mortgage rate swings, the housing market has left a lot of people wondering what’s next – and whether now is really the right time to move. There is one place you can turn to for answers you want the most. And that’s the experts.…

Summer 2025 - Things to Consider When Buying & Selling

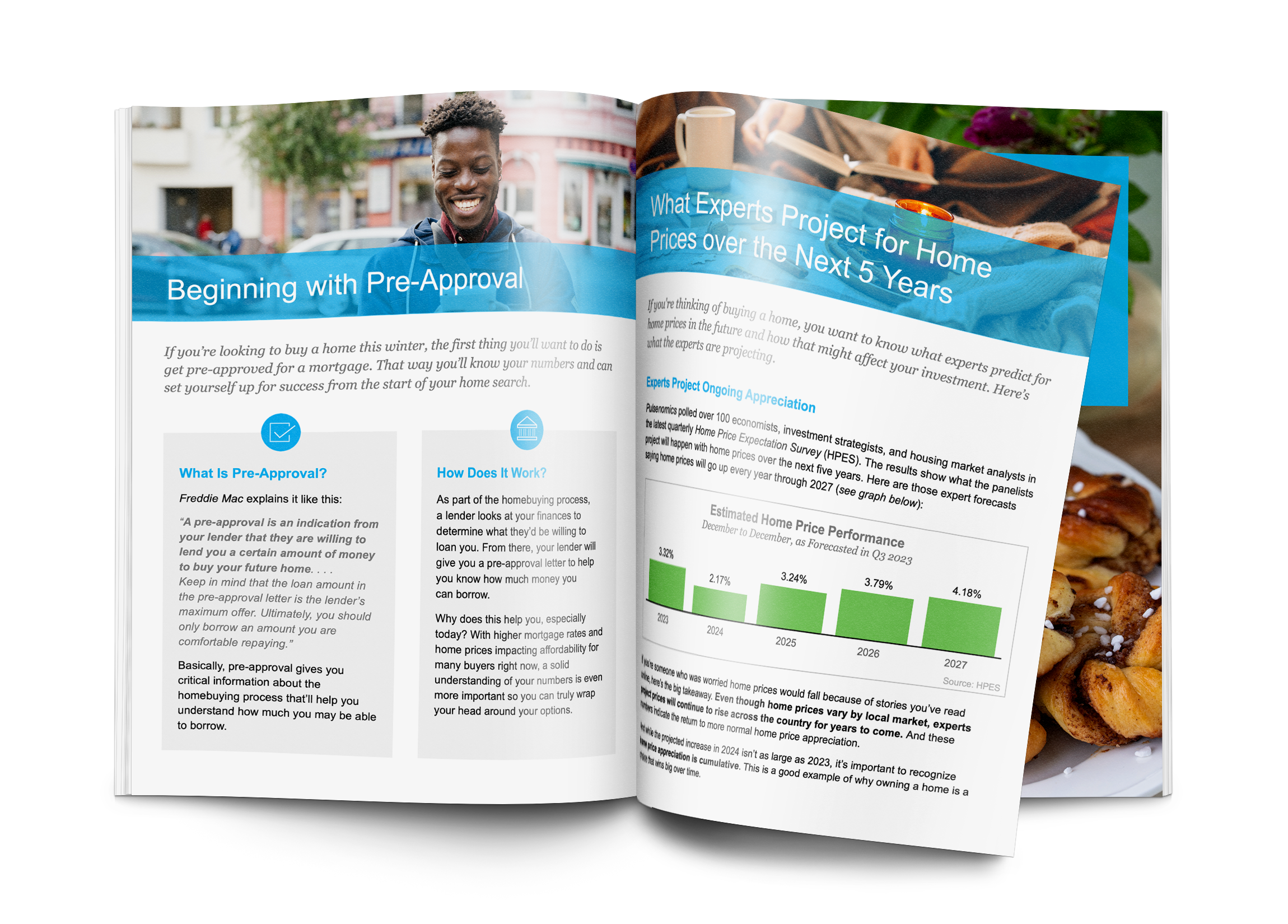

Thinking About Buying a Home?

The process of buying a home can be overwhelming at times, but you don’t need to go through it alone.

You may be wondering if now is a good time to buy a home…or if interest rates are projected to rise or fall. The free eGuide below will answer many of your questions and likely bring up a few things you didn’t even know you should consider when buying a home.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

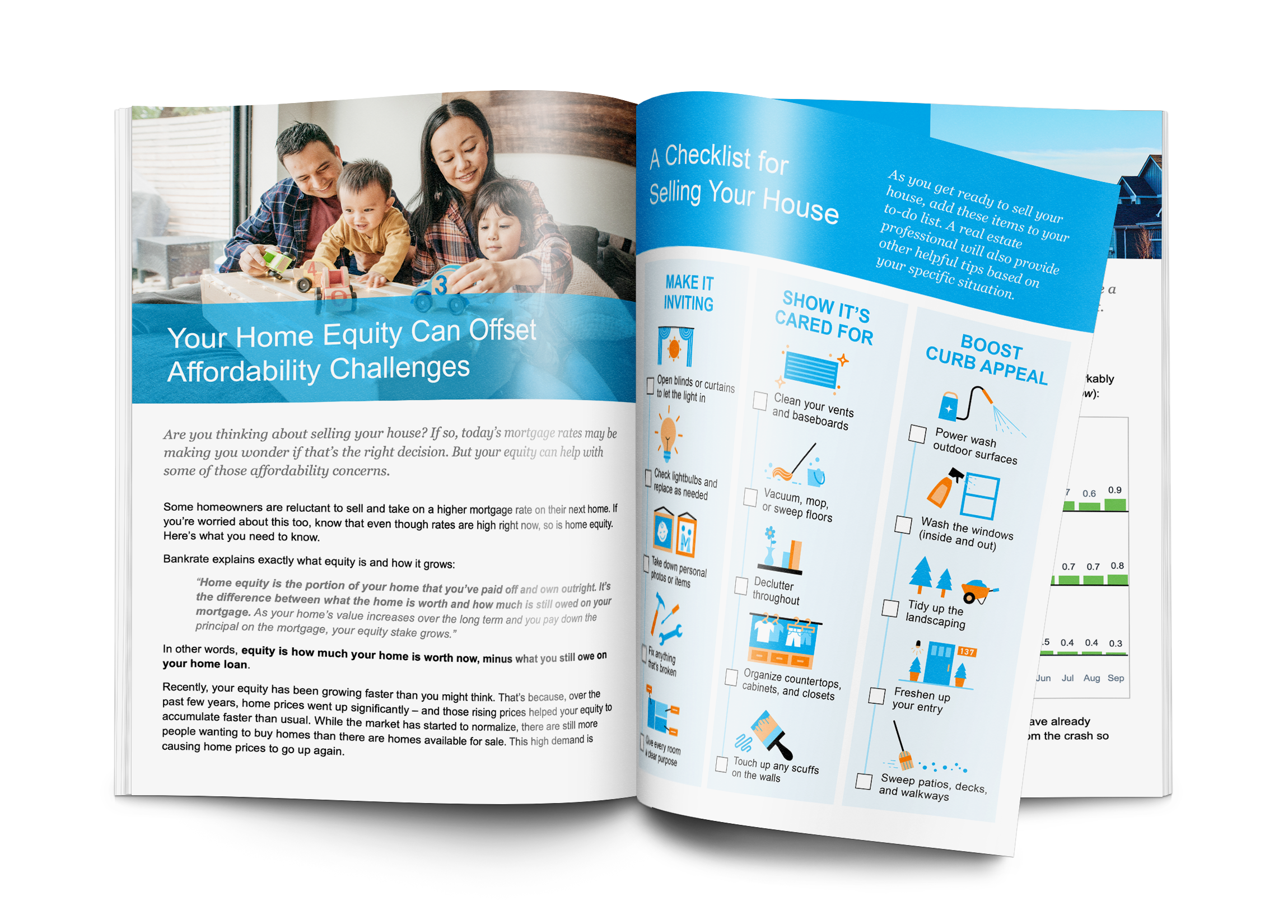

Thinking About Selling Your House Soon?

It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone.

You may be wondering if prices are projected to rise or fall…or how much competition you may be facing in your market. The free eGuide below will answer many of your questions and likely bring up a few things you haven’t even thought about yet.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

FREE Mortgage Payment Calculator & Mortgage Rate Updates