Saturday Strategy

Mortgage FAQ's, did you knows and much more...

Mortgage Credit Certificate - Arizona

I'm here to share a valuable tip with you about Mortgage Credit Certificate (MCC). If you're a first time home homebuyer, especially with moderate income, this could be a game-changer.

Understanding MCC: MCC is a program designed to assist low to moderate-income homebuyers in reducing their tax burden through an IRS tax credit. It's a tool we recently used to help two families, and it's something more people should know about.

The Cool Factor: What's truly fascinating is that many lenders are unaware of this fantastic benefit – you can use the MCC tax credit as part of your income. In some cases, it can even be applied to lower mortgage insurance costs, further reducing your monthly payments. The best part? This benefit is for the entire life of your loan.

Qualification and Application: To be eligible, you must be buying a home for your primary residence and meet specific income and purchase price limits. If you think you or someone you know might qualify for this program, especially first-time homebuyers, don't hesitate to reach out. The MCC opportunity is ongoing, and once you secure it, you can use it for the entire duration of your mortgage as long as you qualify each year.

Why It Matters: With the growing affordability challenge in the housing market, finding additional income through programs like MCC is crucial. This tax credit can be worth up to $2,000 annually, making a significant impact on your qualification.

Conclusion: Thank you for tuning in. If you know someone who could benefit from this information, please share it with them. Whether it's to ease the path to homeownership or just to enjoy that extra $2,000 every year, MCC is worth exploring.

For more info go to https://cictucson.org/mcc/

This is available in states outside of Arizona and we can help with that too! just give us a call at 480.553.8770

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770.

Time in the Market Beats Timing the Market

Monday January 6th, 2025 For Buyers, Equity Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play…

Should You Sell Your House As-Is or Make Repairs?

Should You Sell Your House As-Is or Make Repairs? A recent study from the National Association of Realtors (NAR) shows most sellers (61%) completed at least minor repairs when selling their house. But sometimes life gets in the way and that’s just not possible. Maybe that’s why, 39% of sellers chose to sell as-is instead (see chart below): If you’re feeling stressed because…

Renting vs. Buying: The Net Worth Gap You Need To See

Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth. Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finances (SCF). It shows how much wealth homeowners and renters have – and the difference is significant. On…

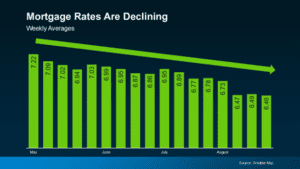

Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

If you’ve been keeping an eye on the housing market the last few years, you likely already know how much the mortgage rates have significantly impacted the industry. Many people (maybe yourself included) have found it extremely challenging to afford jumping into the market. However, recent developments offer some encouraging news—mortgage rates have begun to…

Understanding Mortgage Trigger Leads: A Guide for Homebuyers

Starting your journey to secure a mortgage can unexpectedly open the floodgates to calls, emails, and letters from various mortgage lenders. This overwhelming influx is often due to something called “mortgage trigger leads.” If it feels like your personal information is suddenly in high demand, you’re not alone. Many homebuyers find this practice intrusive. We’re…

7 ROUTINES TO MAKE YOUR DAYS MORE PRODUCTIVE

Follow a Regular Sleep Schedule. Getting a good night’s sleep is the first step to being more productive and accomplishing more in the day. Experts say waking up at the same time each day supports healthier sleep. Do Some Morning Tasks the Night Before. There are lots of little things to do in the morning before you…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!