Saturday Strategy

Mortgage FAQ's, did you knows and much more...

Is it better to reduce the price or apply money to a Temporary Seller Buydown option?

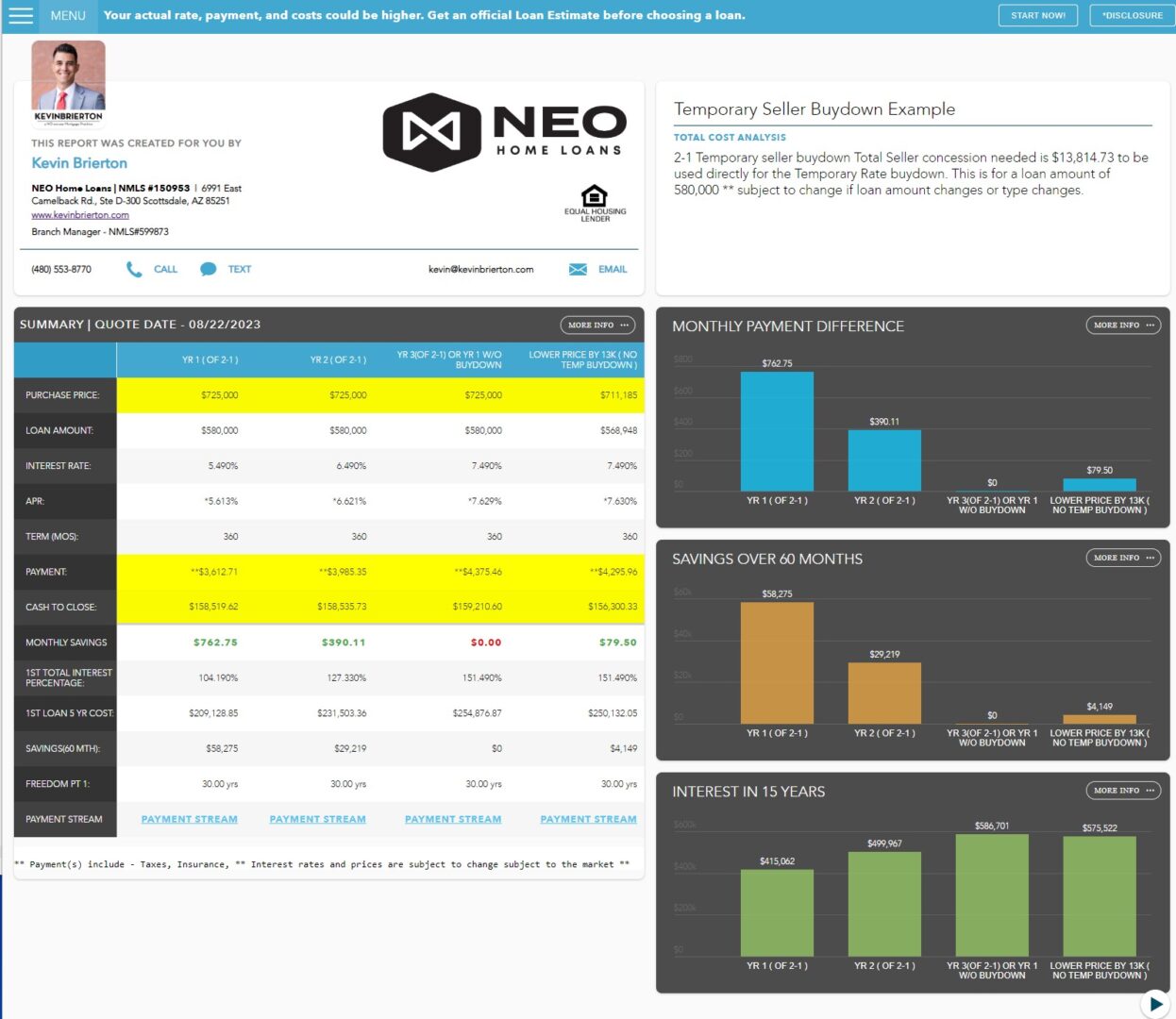

With rates and home prices at all time highs, I wanted to provide you with a clear understanding of the 2-1 Temporary Seller Buydown option, which can be a beneficial arrangement for both buyers and sellers in a real estate transaction.

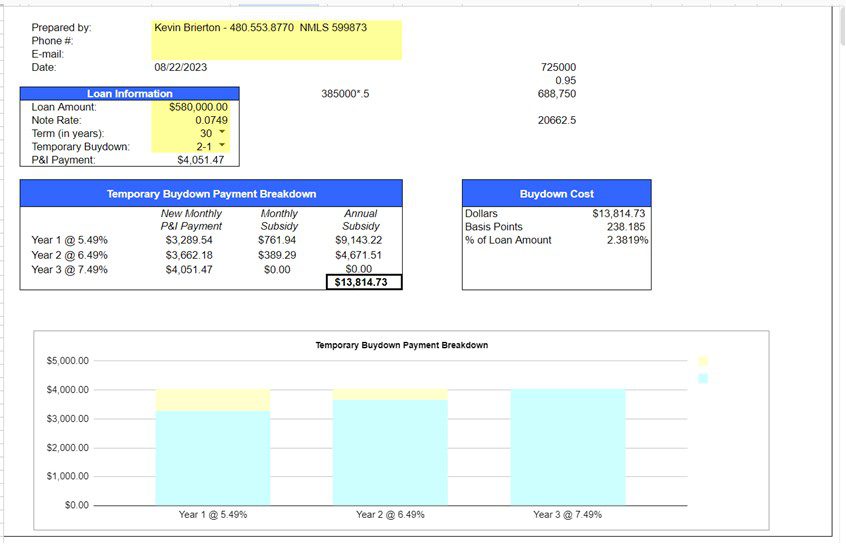

In a 2-1 Temporary Seller Buydown, the seller agrees to contribute a certain amount of money upfront to reduce the interest rate on the buyer's mortgage loan for the first two years of the loan term. This results in lower monthly mortgage payments for the buyer during the initial years of homeownership.

Here's how it works:

- Seller Contribution: The seller allocates funds to the buyer's mortgage lender. This money is used to cover the interest rate reduction for the first two years.

- Interest Rate Reduction: The buyer's interest rate is temporarily "bought down" for the initial two years. This means the buyer pays a lower interest rate than the standard market rate during this period.

- Monthly Savings: As a result of the reduced interest rate, the buyer enjoys lower monthly mortgage payments during the first two years. This can make homeownership more affordable and manageable, especially during the early stages.

- Long-Term Benefits: While the seller buydown helps the buyer save money initially, it's important to note that the interest rate will gradually increase to the original market rate after the initial two-year period.

This arrangement can make a property more attractive to potential buyers, as it provides immediate financial relief during the crucial initial years of homeownership. For sellers, it can help expedite the sale of the property by offering a more competitive financing option.

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770. * Did you know we can finance in 45 states?

Here is an example of clear mortgage plan for a 2-1 Temporary Seller Buydown option

The Perks of Buying a Fixer-Upper

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner. If you’re willing to roll up your sleeves (or hire someone who will), buying a house that needs some work could open the door to homeownership. Here’s everything you…

Why More People Are Buying Multi-Generational Homes Today

Today, 17% of homebuyers are choosing multi-generational homes — that’s when you buy a house with your parents, adult children, or even distant relatives. What makes that noteworthy is that 17% is actually the highest level ever recorded by the National Association of Realtors (NAR). But what’s driving the recent rise in multi-generational living? Top Benefits of Choosing a Multi-Generational Home In…

If Your House’s Price Is Not Compelling, It’s Not Selling

There’s one big mistake you need to avoid when you sell your house this year: setting your price too high. It might seem like overpricing gives you room to negotiate or could really boost your profit, but the reality is, it usually backfires. In fact, Realtor.com says almost 20% of sellers — that’s one in five — have to reduce their price…

One Homebuying Step You Don’t Want To Skip: Pre-Approval

There’s one essential step in the homebuying process you may not know a whole lot about and that’s pre-approval. Here’s a rundown of what it is and why it’s so important right now. What Is Pre-Approval? Pre-approval is like getting a green light from a lender. It lets you know how much they’re willing to let you…

Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Let’s face it – life can throw some curveballs. Whether it’s a job loss, unexpected bills, or a natural disaster, financial struggles can happen to anyone. But here’s the good news. If you’re a homeowner feeling the squeeze, there’s a lifeline that many people don’t realize is still available: mortgage forbearance. What Is Mortgage Forbearance? As Bankrate explains: “Mortgage…

Time in the Market Beats Timing the Market

Monday January 6th, 2025 For Buyers, Equity Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!