Saturday Strategy

Mortgage FAQ's, did you knows and much more...

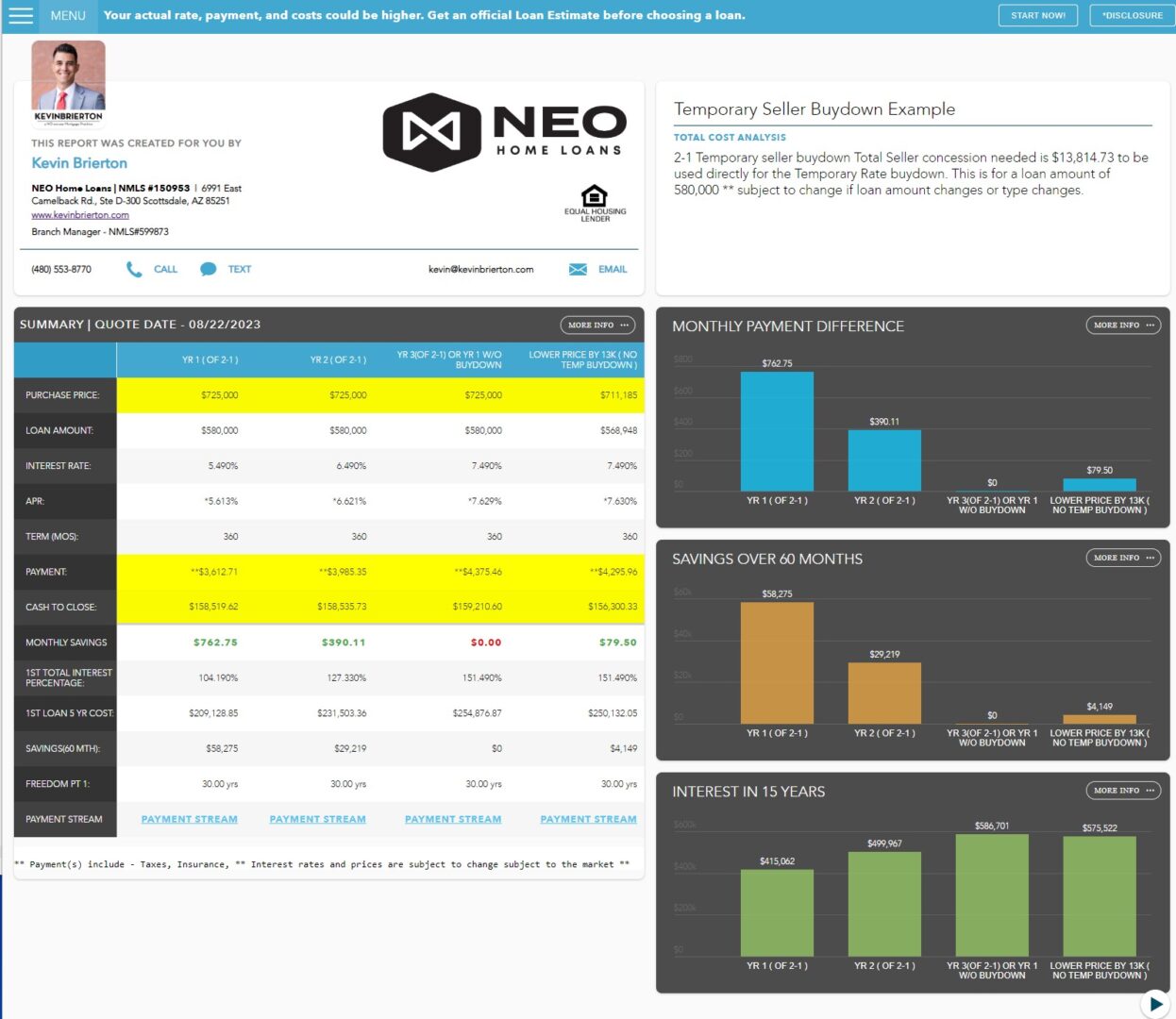

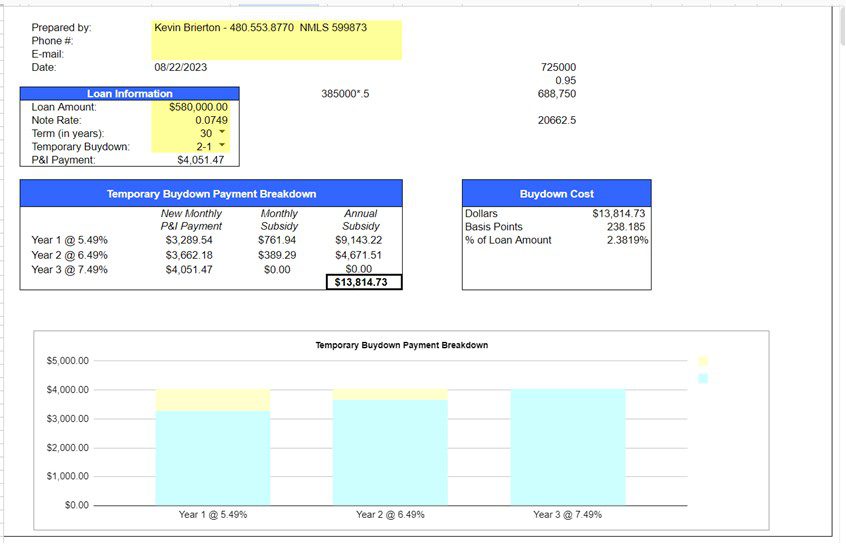

Is it better to reduce the price or apply money to a Temporary Seller Buydown option?

With rates and home prices at all time highs, I wanted to provide you with a clear understanding of the 2-1 Temporary Seller Buydown option, which can be a beneficial arrangement for both buyers and sellers in a real estate transaction.

In a 2-1 Temporary Seller Buydown, the seller agrees to contribute a certain amount of money upfront to reduce the interest rate on the buyer's mortgage loan for the first two years of the loan term. This results in lower monthly mortgage payments for the buyer during the initial years of homeownership.

Here's how it works:

- Seller Contribution: The seller allocates funds to the buyer's mortgage lender. This money is used to cover the interest rate reduction for the first two years.

- Interest Rate Reduction: The buyer's interest rate is temporarily "bought down" for the initial two years. This means the buyer pays a lower interest rate than the standard market rate during this period.

- Monthly Savings: As a result of the reduced interest rate, the buyer enjoys lower monthly mortgage payments during the first two years. This can make homeownership more affordable and manageable, especially during the early stages.

- Long-Term Benefits: While the seller buydown helps the buyer save money initially, it's important to note that the interest rate will gradually increase to the original market rate after the initial two-year period.

This arrangement can make a property more attractive to potential buyers, as it provides immediate financial relief during the crucial initial years of homeownership. For sellers, it can help expedite the sale of the property by offering a more competitive financing option.

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770. * Did you know we can finance in 45 states?

Here is an example of clear mortgage plan for a 2-1 Temporary Seller Buydown option

Spring into Action: Boost Your Home’s Curb Appeal with Expert Guidance

Kevin Brierton – 2.20.2023 To sell your home this spring, it may need more preparation than it would have a year or two ago. Today’s housing market has a different feel. There are more homes for sale than there were at this time last year, but inventory is still historically low. So, if a house has been…

Wondering What’s Going on with Home Prices?

Kevin Brierton – 2.16.2023 The recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices. Local price trends still vary by market. But looking at national…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!