Saturday Strategy

Mortgage FAQ's, did you knows and much more...

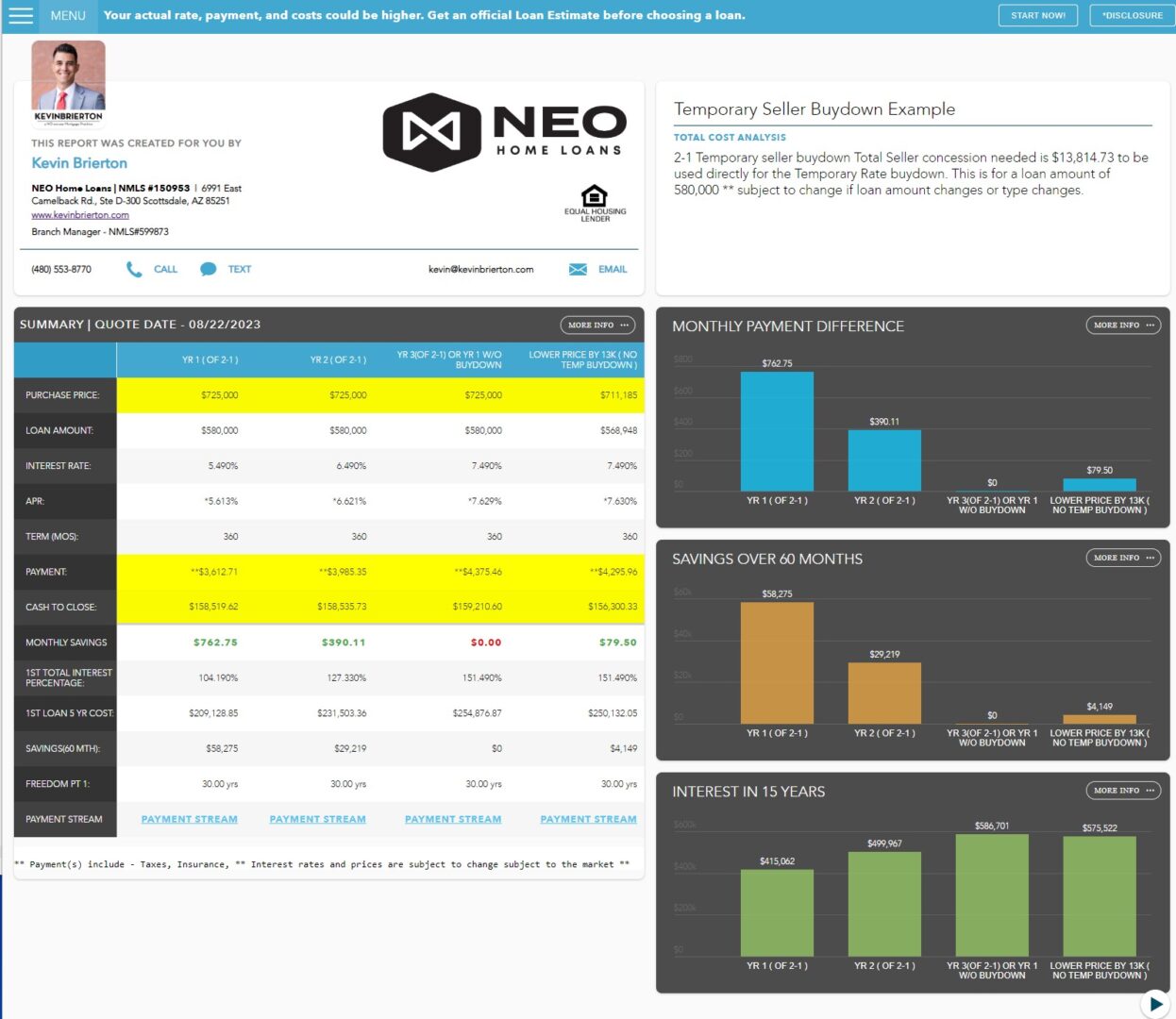

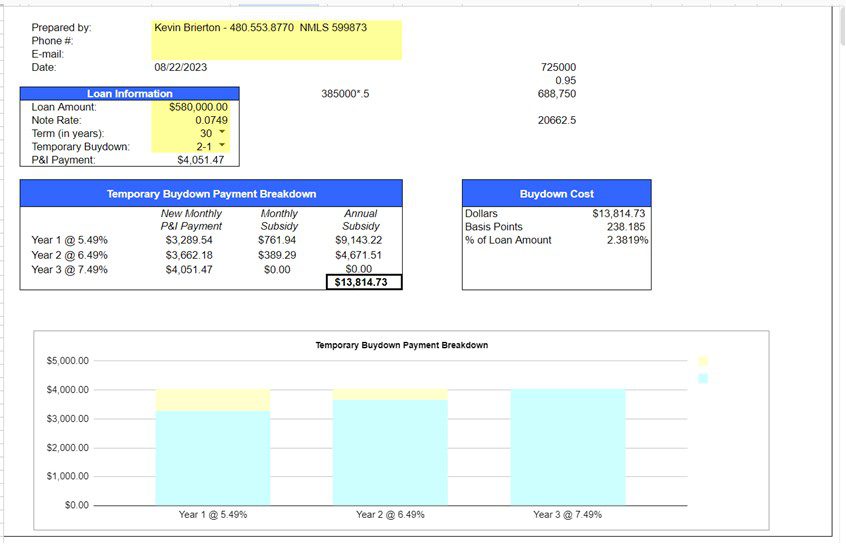

Is it better to reduce the price or apply money to a Temporary Seller Buydown option?

With rates and home prices at all time highs, I wanted to provide you with a clear understanding of the 2-1 Temporary Seller Buydown option, which can be a beneficial arrangement for both buyers and sellers in a real estate transaction.

In a 2-1 Temporary Seller Buydown, the seller agrees to contribute a certain amount of money upfront to reduce the interest rate on the buyer's mortgage loan for the first two years of the loan term. This results in lower monthly mortgage payments for the buyer during the initial years of homeownership.

Here's how it works:

- Seller Contribution: The seller allocates funds to the buyer's mortgage lender. This money is used to cover the interest rate reduction for the first two years.

- Interest Rate Reduction: The buyer's interest rate is temporarily "bought down" for the initial two years. This means the buyer pays a lower interest rate than the standard market rate during this period.

- Monthly Savings: As a result of the reduced interest rate, the buyer enjoys lower monthly mortgage payments during the first two years. This can make homeownership more affordable and manageable, especially during the early stages.

- Long-Term Benefits: While the seller buydown helps the buyer save money initially, it's important to note that the interest rate will gradually increase to the original market rate after the initial two-year period.

This arrangement can make a property more attractive to potential buyers, as it provides immediate financial relief during the crucial initial years of homeownership. For sellers, it can help expedite the sale of the property by offering a more competitive financing option.

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770. * Did you know we can finance in 45 states?

Here is an example of clear mortgage plan for a 2-1 Temporary Seller Buydown option

📈 Buyers Keep Coming: Purchase Apps Up 18% From Last Year 🏡

Buyers Keep Coming – Inside Lending Week of 5.19.25 QUOTE OF THE WEEK “Do not let what you cannot do interfere with what you can do.”—John Wooden, American basketball coach and player NATIONAL MARKET UPDATE The Mortgage Bankers Association reports homebuyers came out in strength for the second week in a row, pushing purchase mortgage…

Housing Market Forecasts for the Second Half of 2025

🏡 Housing Market Forecasts for the Second Half of 2025 As we enter the latter half of 2025, the housing market presents a mix of challenges and opportunities. Understanding the current trends can help buyers and sellers make informed decisions. 📉 Mortgage Rates: A Gradual Decline Mortgage rates have been a significant factor in the…

📌 FHA Loan FAQ: Do I Need a Manual Downgrade for a Decline in Self-Employment Income?

Question:My client has W-2 income and some side self-employment income that declined by more than 20% this year. We’re not using that income to qualify — do I still need to downgrade to a manual underwrite? Answer:No — as long as the self-employment income is not used to qualify the borrower, a manual downgrade is…

Don’t Let Student Loans Hold You Back from Homeownership

Wednesday May 14th, 2025 For Buyers, First-Time Buyers, Buying Tips Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you’re wondering: Having questions like these is normal, especially when you’re thinking about making such a big purchase.…

Why Buyers Are More Likely To Get Concessions Right Now

Tuesday May 13th, 2025 For Buyers, Buying Tips Especially in areas where inventory is rising, both homebuilders and sellers are sweetening the deal for buyers with things like paid closing costs, mortgage rate buy-downs, and more. In the industry, it’s called a concession or an incentive. What Are Concessions and Incentives? When a seller or builder…

Home Projects That Boost Value

Monday May 12th, 2025 For Sellers, Equity, Selling Tips Whether you’re planning to move soon or not, it’s smart to be strategic about which home projects you take on. Your time, energy, and money matter – and not all upgrades offer the payoff you might expect. As U.S. News Real Estate explains: “. . . not every home renovation…

Housing Market Forecasts for the Second Half of the Year

Thursday May 8th, 2025 Mortgage Rates, Forecasts From rising home prices to mortgage rate swings, the housing market has left a lot of people wondering what’s next – and whether now is really the right time to move. There is one place you can turn to for answers you want the most. And that’s the experts.…

Why Some Homes Sell Faster Than Others

Wednesday May 7th, 2025 For Sellers, Selling Tips As you think ahead to your own move, you may have noticed some houses sell within days, while others linger. But why is that? As Redfin says: “. . . today’s housing market has been topsy-turvy since the pandemic. Low inventory (though rising) and high prices have created a strange…

Stocks May Be Volatile, but Home Values Aren’t

Tuesday May 6th, 2025 Home Prices, Economy With all the uncertainty in the economy, the stock market has been bouncing around more than usual. And if you’ve been watching your 401(k) or investments lately, chances are you’ve felt that pit in your stomach. One day it’s up. The next day, it’s not. And that may make…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!