Saturday Strategy

Mortgage FAQ's, did you knows and much more...

Beware of Homeowner "Final Notice" Letters... Read the fine print

I recently received a call from a past client who received a letter similar to this one. Unfortunately, I was unable to prevent them from paying for a home warranty they didn't need.

I want to caution you about letters that arrive in the mail and use scare tactics to prompt action. These third-party entities may attempt to sell you unnecessary life insurance, home warranties, or even charge you for a copy of your deed of trust. In this week's Saturday Strategy video, I will share an example of a mailer I recently received.

It is crucial to carefully read the fine print and remember that you can always send us a photo of the mailer to obtain our opinion before taking any action.

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770.

* Did you know we can finance in 45 states?

Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Let’s face it – life can throw some curveballs. Whether it’s a job loss, unexpected bills, or a natural disaster, financial struggles can happen to anyone. But here’s the good news. If you’re a homeowner feeling the squeeze, there’s a lifeline that many people don’t realize is still available: mortgage forbearance. What Is Mortgage Forbearance? As Bankrate explains: “Mortgage…

Time in the Market Beats Timing the Market

Monday January 6th, 2025 For Buyers, Equity Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play…

Should You Sell Your House As-Is or Make Repairs?

Should You Sell Your House As-Is or Make Repairs? A recent study from the National Association of Realtors (NAR) shows most sellers (61%) completed at least minor repairs when selling their house. But sometimes life gets in the way and that’s just not possible. Maybe that’s why, 39% of sellers chose to sell as-is instead (see chart below): If you’re feeling stressed because…

Renting vs. Buying: The Net Worth Gap You Need To See

Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth. Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finances (SCF). It shows how much wealth homeowners and renters have – and the difference is significant. On…

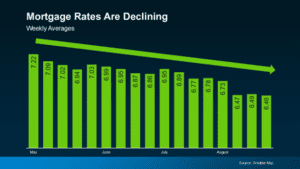

Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

If you’ve been keeping an eye on the housing market the last few years, you likely already know how much the mortgage rates have significantly impacted the industry. Many people (maybe yourself included) have found it extremely challenging to afford jumping into the market. However, recent developments offer some encouraging news—mortgage rates have begun to…

Understanding Mortgage Trigger Leads: A Guide for Homebuyers

Starting your journey to secure a mortgage can unexpectedly open the floodgates to calls, emails, and letters from various mortgage lenders. This overwhelming influx is often due to something called “mortgage trigger leads.” If it feels like your personal information is suddenly in high demand, you’re not alone. Many homebuyers find this practice intrusive. We’re…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!