Saturday Strategy

Mortgage FAQ's, did you knows and much more...

Bridge loan comparisons

We know many of you are navigating the tricky waters of selling one house and buying another. Whether you're considering this for your primary residence or investment properties, we have a solution that could be a game-changer.

Here's a quick rundown of the key points:

Bridge Loans Explained: Our Bridge Loan Program allows you to secure a loan on the house you're selling. This means you don't have to worry about leaving your current home or having a mortgage on it.

Investment Properties Included: This isn't just for your primary residence. It's also designed for investment properties, giving you flexibility and options.

Cash Buying Power: With this bridge loan, you can use the secured funds to buy your new property in cash. No need to identify your next home upfront.

Interest Rates Vary: Keep in mind that interest rates may vary based on factors like credit scores, so we'll work closely with you to find the best solution.

Not All Lenders Offer This: While this fantastic program is available, it's not offered by every lender. It's essential to do your homework and work with experts like us who understand the intricacies.

Check out are comparison I ran comparing a new first mortgage, 1st mortgage and HELOC and a bridge loan. -- https://mcedge.tv/46ed8o

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770.

Should You Sell Your House As-Is or Make Repairs?

Should You Sell Your House As-Is or Make Repairs? A recent study from the National Association of Realtors (NAR) shows most sellers (61%) completed at least minor repairs when selling their house. But sometimes life gets in the way and that’s just not possible. Maybe that’s why, 39% of sellers chose to sell as-is instead (see chart below): If you’re feeling stressed because…

Renting vs. Buying: The Net Worth Gap You Need To See

Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth. Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finances (SCF). It shows how much wealth homeowners and renters have – and the difference is significant. On…

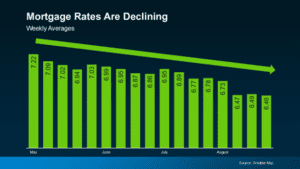

Finding Your Ideal Mortgage Rate: What Number Are You Waiting For?

If you’ve been keeping an eye on the housing market the last few years, you likely already know how much the mortgage rates have significantly impacted the industry. Many people (maybe yourself included) have found it extremely challenging to afford jumping into the market. However, recent developments offer some encouraging news—mortgage rates have begun to…

Understanding Mortgage Trigger Leads: A Guide for Homebuyers

Starting your journey to secure a mortgage can unexpectedly open the floodgates to calls, emails, and letters from various mortgage lenders. This overwhelming influx is often due to something called “mortgage trigger leads.” If it feels like your personal information is suddenly in high demand, you’re not alone. Many homebuyers find this practice intrusive. We’re…

7 ROUTINES TO MAKE YOUR DAYS MORE PRODUCTIVE

Follow a Regular Sleep Schedule. Getting a good night’s sleep is the first step to being more productive and accomplishing more in the day. Experts say waking up at the same time each day supports healthier sleep. Do Some Morning Tasks the Night Before. There are lots of little things to do in the morning before you…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!