Saturday Strategy

Mortgage FAQ's, did you knows and much more...

Bridge loan comparisons

We know many of you are navigating the tricky waters of selling one house and buying another. Whether you're considering this for your primary residence or investment properties, we have a solution that could be a game-changer.

Here's a quick rundown of the key points:

Bridge Loans Explained: Our Bridge Loan Program allows you to secure a loan on the house you're selling. This means you don't have to worry about leaving your current home or having a mortgage on it.

Investment Properties Included: This isn't just for your primary residence. It's also designed for investment properties, giving you flexibility and options.

Cash Buying Power: With this bridge loan, you can use the secured funds to buy your new property in cash. No need to identify your next home upfront.

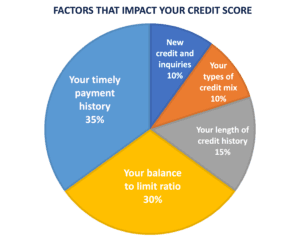

Interest Rates Vary: Keep in mind that interest rates may vary based on factors like credit scores, so we'll work closely with you to find the best solution.

Not All Lenders Offer This: While this fantastic program is available, it's not offered by every lender. It's essential to do your homework and work with experts like us who understand the intricacies.

Check out are comparison I ran comparing a new first mortgage, 1st mortgage and HELOC and a bridge loan. -- https://mcedge.tv/46ed8o

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770.

Why You Shouldn’t Fear Today’s Foreclosure Headlines

kevin Brierton – 1.25.2023 If you’ve seen recent headlines about foreclosures surging in the housing market, you’re certainly not alone. There’s no doubt, the stories in the media can be pretty confusing right now. They may even make you think twice about buying a home for fear that prices could crash. The reality is, the data shows…

Want To Sell Your House? Price It Right.

Kevin Brierton – 1.23.2023 Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you’re considering selling your house soon, you’ll want to adjust your expectations accordingly. As realtor.com explains: “. . . some of the more prominent pandemic trends have changed, so sellers might wish…

Have Home Values Hit Bottom?

Kevin Brierton – 1.18.2023 Whether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that’s raising concerns about a repeat of what happened to prices in the crash in 2008. One of the questions that’s on…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!