Paused Your Moving Plans? Here’s Why It’s Time To Hit Play Again

It’s not really a surprise that 70% of buyers paused their home search last year. Maybe you were one of them. And if so, no judgment. Conditions just weren’t great.

Inventory was too low, prices were too high, and mortgage rates were bouncing all over. That made it really hard to find a home you loved – and could afford. And why sell if you’re not sure where you’re going to go?

But here’s the thing: the market’s shifting. And it might be time to hit play again.

The Inventory Sweet Spot

More homeowners are jumping back into their search to make a move this year. Builders are finishing more homes. And together, that’s creating more options for you when you move – maybe even the home you’ve been waiting for.

More homes = more possibilities.

But there’s more to it than that. When you sell, you don’t want to feel like it’s impossible to find your next home. At the same time, you also don’t want inventory to be so high, it takes ages for your house to sell. Right now, you’ll get the best of both worlds.

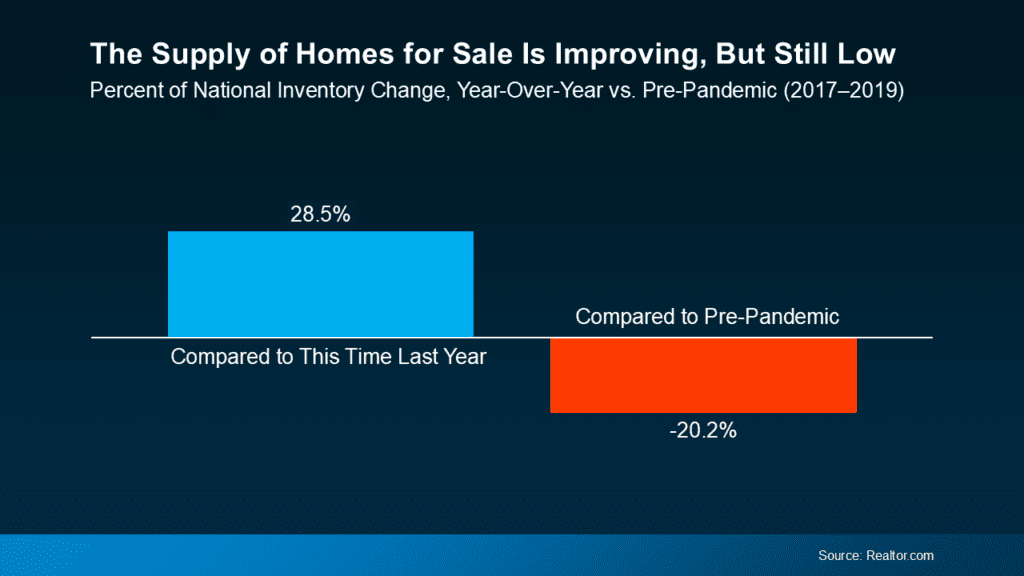

This data will help paint the picture for you. According to Realtor.com, inventory has jumped 28.5% since this time last year, but it’s still below pre-pandemic levels in most markets – and here’s why this is such a sweet spot (see graph below):

Basically, there are more homes to choose from when you make your move, but not so many that you’ll struggle to sell your current house. Your home should sell quickly if you work with an agent to make sure it’s priced right and prepped to impress.

More options. Less chaos. Solid demand: That’s the real sweet spot.

But here’s something else to consider. Data from Realtor.com also shows inventory has been on the rise for 17 straight months. And experts agree it’s likely to continue climbing throughout the year. As Lance Lambert, Co-Founder of ResiClub explains:

“The fact that inventory is rising year-over-year . . . strongly suggests that national active housing inventory for sale is likely to end the year higher.”

So, this may actually be the best time to sell. Your house may stand out more now than it would as the year goes on and inventory grows even more. Wait too long, and you may be one of many trying to stand out later this year.

Bottom Line

If you’ve been waiting for the housing market to give you a sign – it just did. Whether you’re looking to move up, scale down, or relocate completely, this might be the best balance we’ve seen in a while.

What’s holding you back from taking advantage of this sweet spot? Let’s talk through it and see what’s possible.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

clear communication, great follow up & on time closings = no excuses

Kevin Brierton

Branch Manager | Certified Mortgage Planning Specialist

NMLS #599873

Advisor. Educator. Lover of anything outdoors. Father of 2 beautiful kids

Kevin Brierton Team at Luminate Bank NMLS #1281698

Call or Text l 480.553.8770

Fax l 480.264.0300

E-Mail l Kevin@KevinBrierton.com

Get Started 24/7 l https://KevinBrierton.com/Apply

Snail Mail l 6991 East Camelback Rd., Ste D-300 Scottsdale AZ 85251

Connect with us on social | www.MeetKevinBrierton.com

Copyright @ 2025 Luminate Bank NMLS #1281698 Corporate Headquarters 2523 S. Wayzata Blvd Suite 200, Minneapolis, MN 55405. This advertisement does not constitute a loan approval or loan commitment. Loan Approval and/or loan commitment is subject to final underwriting review and approval. For licensing information, go to www.nmlsconsumeraccess.org | Equal Housing Lender Member FDIC