Kevin Brierton - Branch Manager CLA, CMPS, NMLS 599873

Your No Excuse Lender

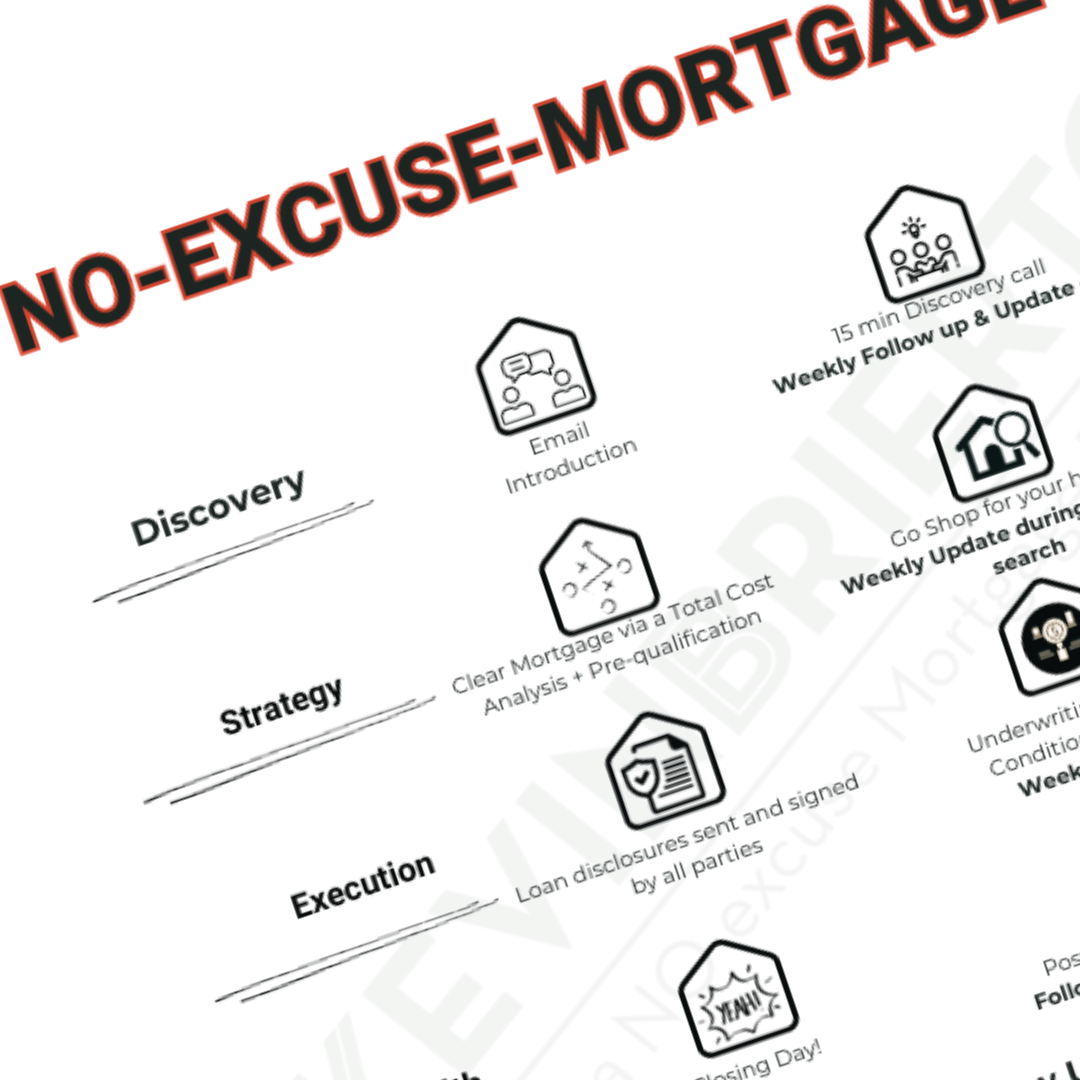

As YOUR NO EXCUSE LENDER, we provide clear communication, great follow-up, and on-time closings—no excuses. Our mission is to empower families and partners with a more confident mortgage experience. We’re not just here for the pre-approval and loan process; we’re committed to guiding our clients for the next 30 years, helping them grow wealth through smart mortgage strategies

Clear Communication +

Great Follow Up +

On Time Closings +

= No Excuses

Kevin Brierton Team

The Kevin Brieton Team is committed to helping our clients grow their wealth and better understand their holistic financial situation, not just to give them debt.

Whether you need a Conventional loan, FHA loan, VA loan, Jumbo loan, Reverse Mortgage, Renovation loan, Home Equity Lines of Credit ( HELOC ) or a non QM Portfolio loan we are here to educate and serve you! Learn more about Loan Types

You Deserve More.... You Deserve a No Excuse Mortgage Process

Are you sick of excuses from lenders & banks? We are too!

We have built a No Excuse Mortgage Process backed by a No Excuse Promise designed to provide an process that provides clear communication, great follow up and on time closings with no excuses.

Families Not Files

Our loan files are titled FAMILIES rather than "files" because the team understands that a family trusts us behind all that paperwork.

We work towards getting these families a place to call home now and into the future. Kevin Brierton Team is here to create lifelong clients with our world-class services.

What Happens to Housing when There’s a Recession?

Kevin Brierton – 10.25.2022 Since the 2008 housing bubble burst, the word recession strikes a stronger emotional chord than it ever did before. And while there’s some debate around whether we’re officially in a recession right now, the good news is experts say a recession today would likely be mild and the economy would rebound…

Summer 2025 - Things to Consider When Buying & Selling

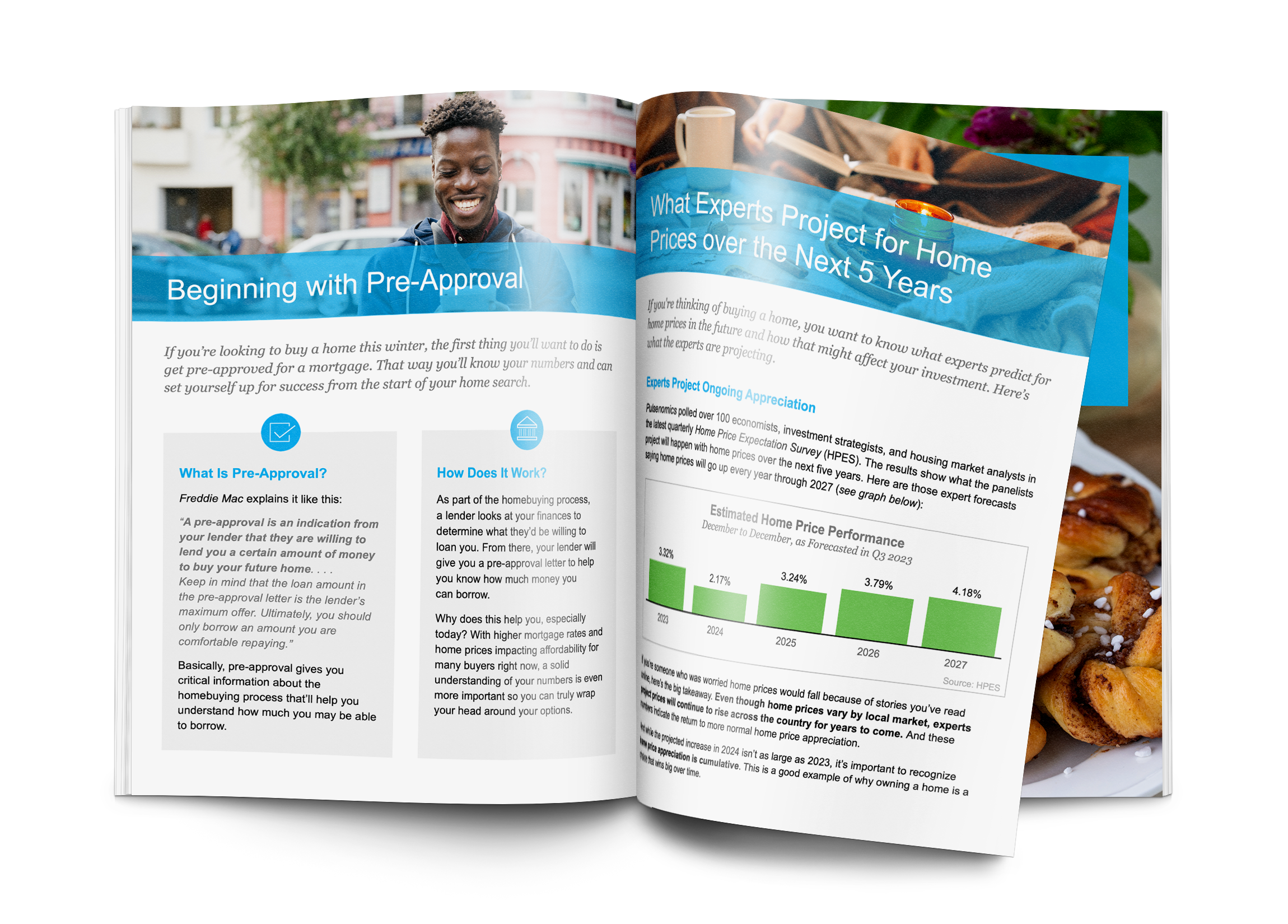

Thinking About Buying a Home?

The process of buying a home can be overwhelming at times, but you don’t need to go through it alone.

You may be wondering if now is a good time to buy a home…or if interest rates are projected to rise or fall. The free eGuide below will answer many of your questions and likely bring up a few things you didn’t even know you should consider when buying a home.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

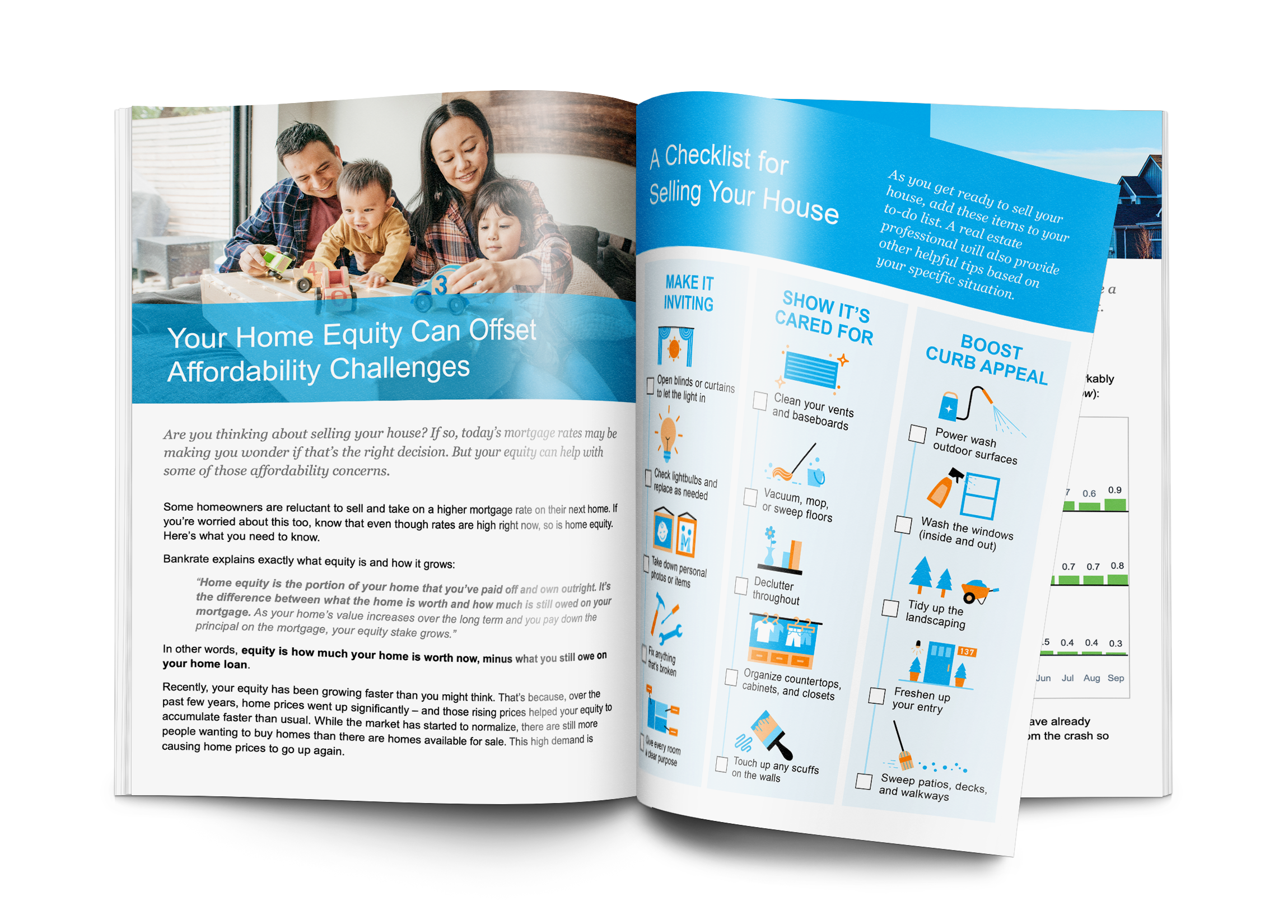

Thinking About Selling Your House Soon?

It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone.

You may be wondering if prices are projected to rise or fall…or how much competition you may be facing in your market. The free eGuide below will answer many of your questions and likely bring up a few things you haven’t even thought about yet.

Simply fill out the form below to receive your copy of the eGuide, and feel free to get in touch if you have any questions.

Click Here to Download

FREE Mortgage Payment Calculator & Mortgage Rate Updates