Housing Market Forecasts for the Second Half of 2025

🏡 Housing Market Forecasts for the Second Half of 2025

As we enter the latter half of 2025, the housing market presents a mix of challenges and opportunities. Understanding the current trends can help buyers and sellers make informed decisions.

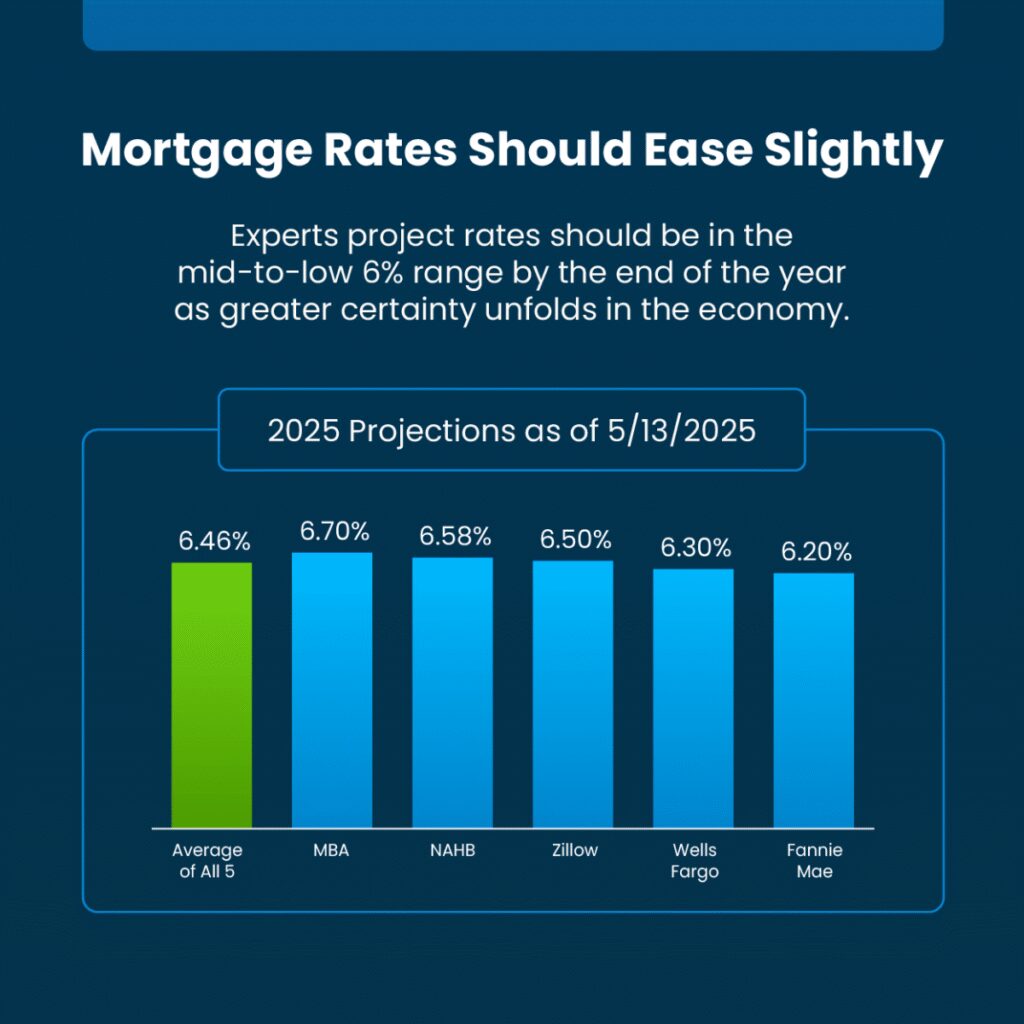

📉 Mortgage Rates: A Gradual Decline

Mortgage rates have been a significant factor in the housing market’s dynamics. In early 2025, the average 30-year fixed mortgage rate hovered around 6.86%. While this is a decrease from the peak rates of 2023, it’s still higher than the historically low rates seen in previous years. Experts predict that rates will remain in the mid-6% range for the remainder of the year, influenced by ongoing economic growth and inflation concerns.

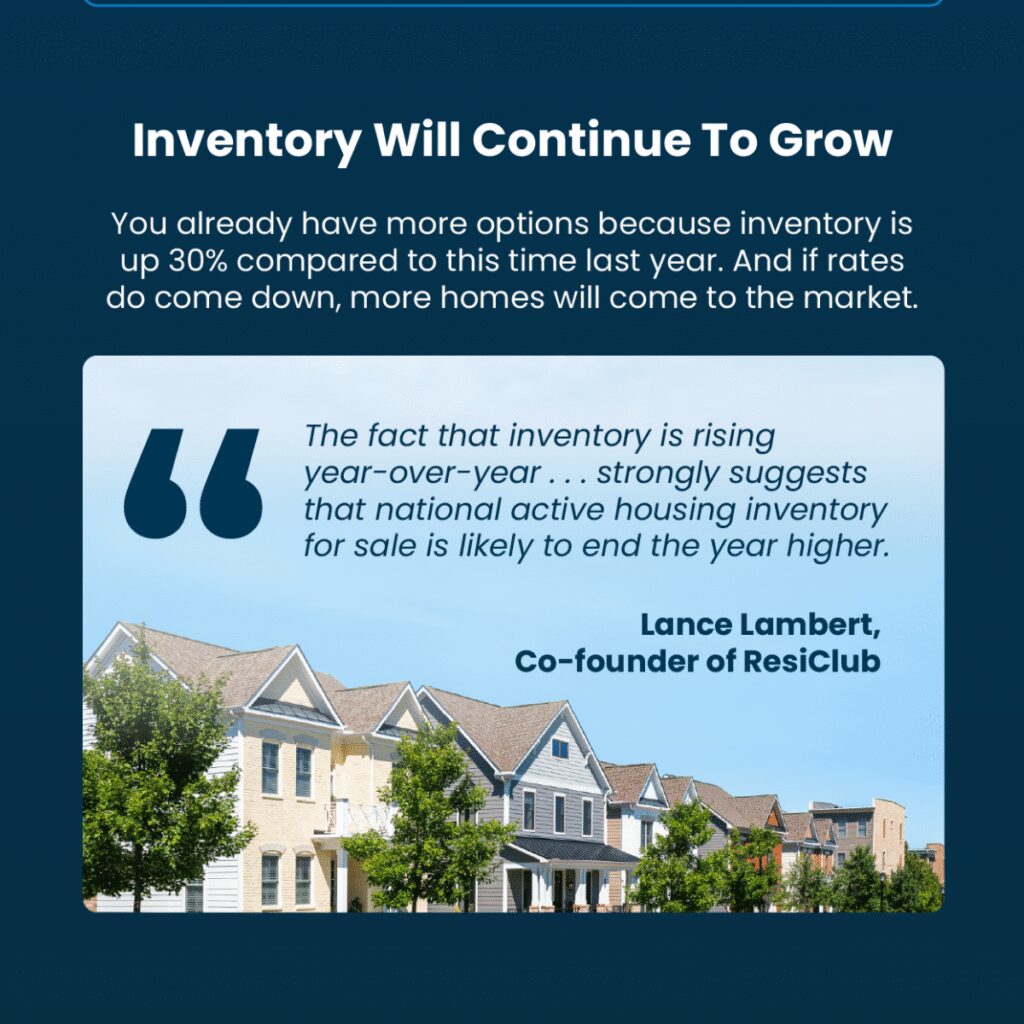

🏘️ Inventory Levels: Slowly Improving

Housing inventory has seen a modest increase, with a 4.0-month supply reported at the end of March 2025. This is up from 3.2 months a year ago, indicating a gradual improvement. However, the market is still below the 5 to 6 months typically needed for a balanced market. The increase in inventory provides buyers with more options, but competition remains, especially in desirable areas.

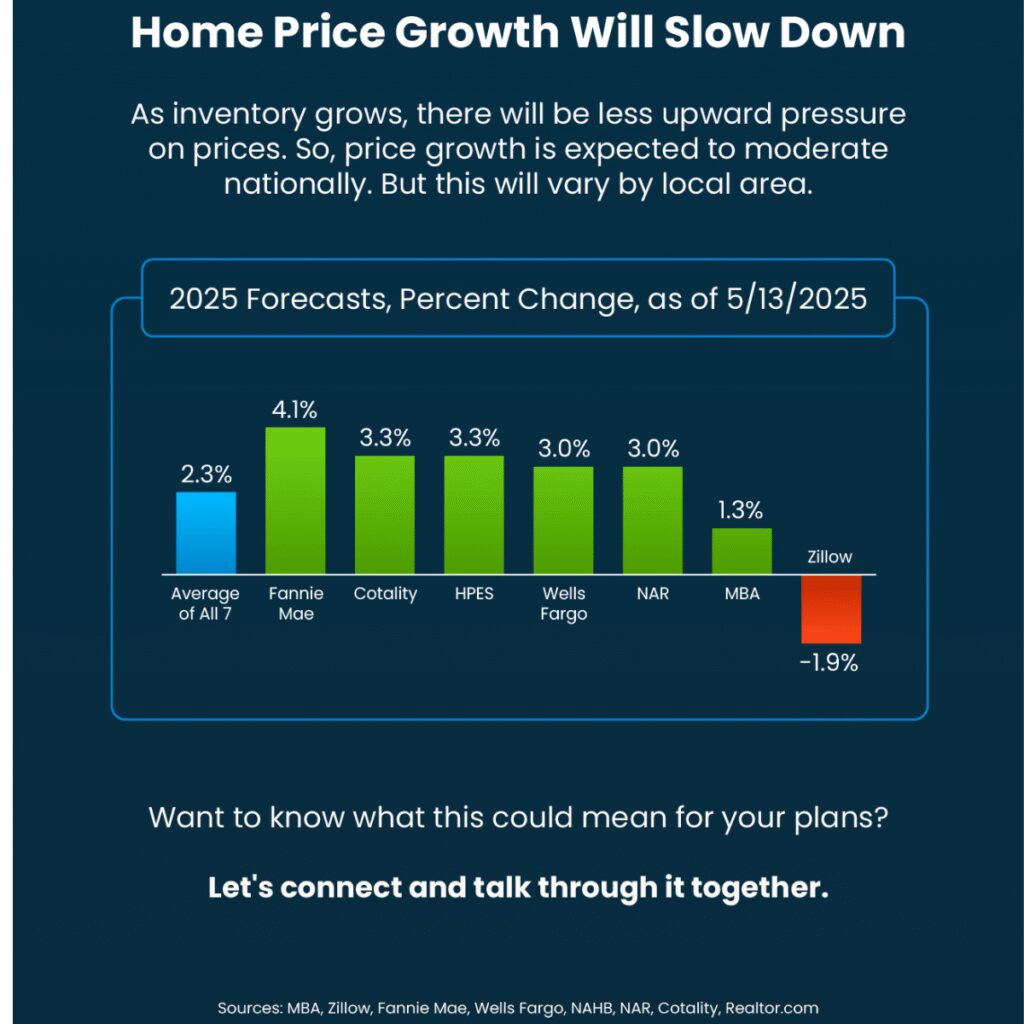

💰 Home Prices: Continued Appreciation

Home prices continue to rise, albeit at a slower pace. The median home-sale price in the U.S. as of March 2025 was $403,700, marking the 21st consecutive month of year-over-year home-price increases. While the rate of appreciation has slowed compared to the rapid gains during the pandemic, affordability remains a concern for many buyers.

🔄 Market Dynamics: A Seller’s Market Persists

Despite the slight improvements in inventory and mortgage rates, the market continues to favor sellers. The limited supply of homes, coupled with steady demand, keeps competition high. Buyers may find some relief in the increased inventory, but the overall market conditions still present challenges.

📝 Bottom Line

The second half of 2025 is expected to bring a housing market that remains competitive, with gradual improvements in inventory and mortgage rates. Buyers should be prepared for continued challenges in affordability and competition, while sellers can still capitalize on favorable market conditions.