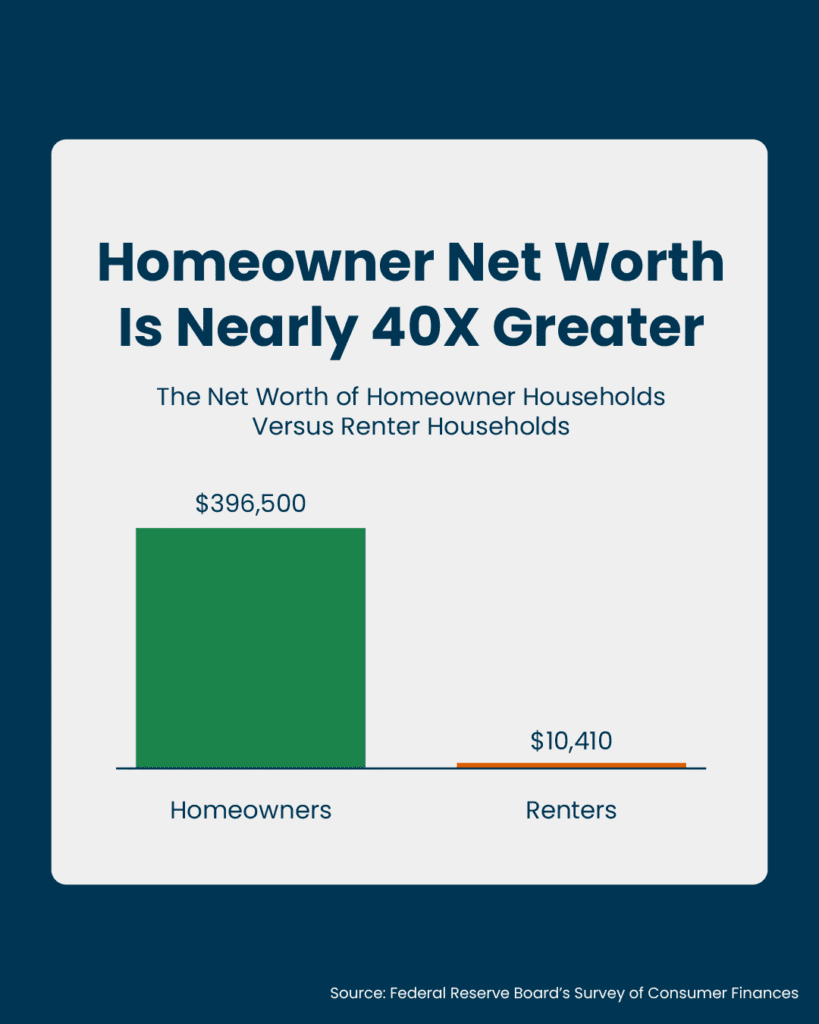

The Big Difference Between Homeowner and Renter Net Worth

If you’re currently renting, you’re not alone—and you’re not wrong for doing it. But if building long-term wealth is one of your goals, it’s worth understanding the financial advantage that homeownership can bring.

Homeowners Build Wealth—Renters Don’t

According to the Federal Reserve, the average net worth of a homeowner is $396,500, compared to just $10,410 for renters. That’s a staggering difference—nearly 40 times greater.

Why Is There Such a Gap?

Homeowners gain equity in two ways:

- By making monthly mortgage payments

- Through long-term home value appreciation

This equity becomes a powerful wealth-building tool that simply doesn’t exist for renters. Renters make monthly payments that build equity—for someone else.

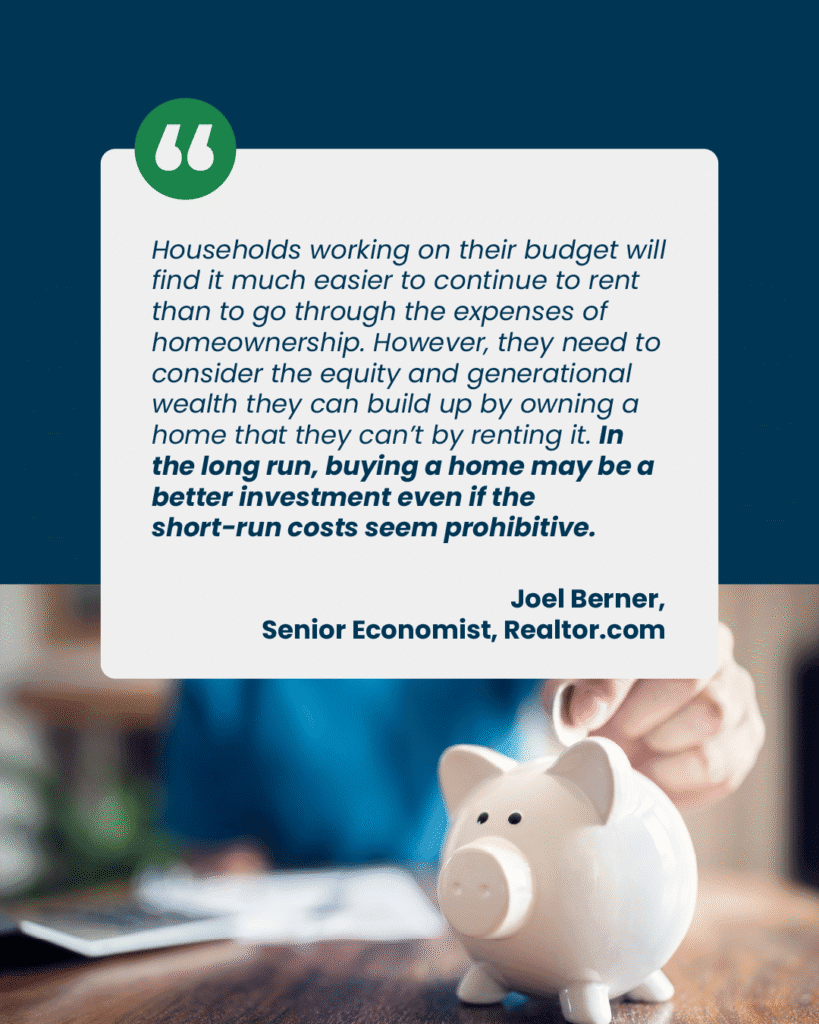

But What About the Cost of Buying?

Yes, homeownership comes with upfront and ongoing costs. And for households on a tight budget, renting can seem like the more manageable option. But as Joel Berner, Senior Economist at Realtor.com, notes:

“In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Should You Rent or Buy?

Renting may seem less expensive now, but over time, it can cost you more in missed opportunities to grow your net worth.

Let’s Build a Plan

If buying a home is something you want to explore—whether it’s now or down the road—let’s create a personalized plan to get you there. It’s not just about owning a home; it’s about owning your financial future.

Schedule an mortgage strategy call today – https://kevinbrierton.com/call