Purchase Mortgage Applications Up

For the week of JUNE 2, 2025 – Inside Lending

QUOTE OF THE WEEK

“The confidence I now have is rooted in the discovery that who I am is okay.”—Dudley Moore, English actor, comedian, musician, and composer

NATIONAL MARKET UPDATE

The Mortgage Bankers Association reported purchase mortgage applications up compared to the week before, with that measure of buyer activity a solid 18% higher than the same week a year ago.

Pending Home Sales, an index of signed contracts on existing homes, fell 6.3% in April, but with inventory at five-year highs, the National Association of Realtors says buyers “are in a better position to negotiate more favorable terms.”

The closely followed Case-Shiller Home Price Index disclosed, “home price growth continued to decelerate on an annual basis in March,” down 0.6% from February, while FHFA home price growth also dipped for the month.

REVIEW OF LAST WEEK

TARIFF TEMPERATURE COOLS… The holiday-shortened week opened with news the President deferred the 50% tariff on the EU until July 9 to allow time for a deal. This boosted the major indexes enough to post gains for the week.

But the road to those gains was choppy, tripped up by April durable goods orders showing a big drop-off in business spending, while the second estimate for Q1 GDP delivered a downward revision for consumer spending.

Yet Consumer Confidence made a huge jump in May after five straight months of decline, and PCE Price inflation, the Fed’s favorite read, dropped to 2.1% in April, with core PCE, excluding volatile food and energy prices, at 2.5%.

The week ended with the Dow UP 1.6%, to 42,270; the S&P 500 UP 1.9%, to 5,912; and the Nasdaq UP 2,0%, to 19.114.

Bond prices also headed north overall, the 30-Year UMBS 5.5% UP 0.19, to 98.27. In Freddie Mac’s Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate edged up a tiny bit, but remains below a year ago. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… The price gap between new and existing homes has narrowed to a $14,600 average in Q1 2025, from $64,000 in Q4 2022. And when factoring in buyer incentives from builders, the gap can disappear.

THIS WEEK’S FORECAST

CONSTRUCTION SPENDING, MANUFACTURING, SERVICES, JOBS… April Construction Spending is expected grow overall, and we’ll focus on the residential part. Analysts predict the May ISM Manufacturing Index will report that sector of the economy still in contraction territory, while the ISM Services Index will show that far larger sector expanding at a greater rate. Economists forecast a moderate gain in new Nonfarm Payrolls for May, with Average Hourly Earnings up, and the Unemployment Rate holding.

FEDERAL RESERVE WATCH

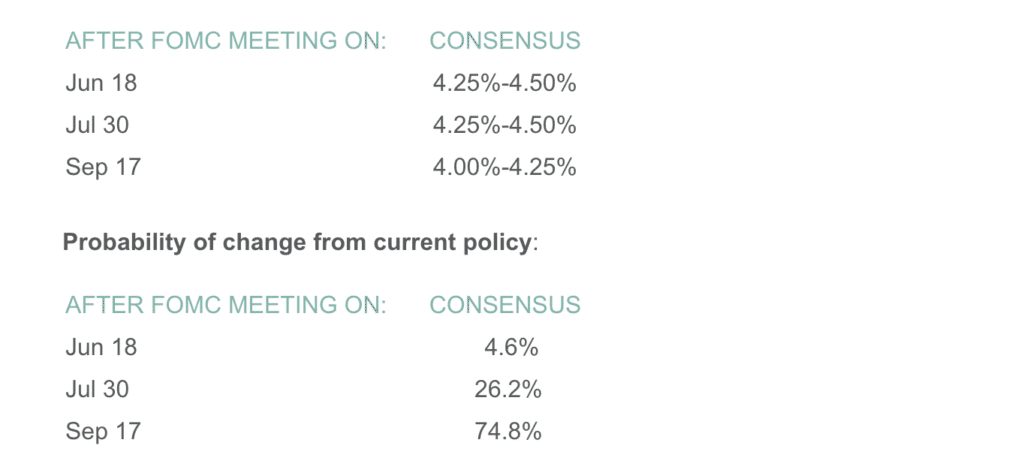

Forecasting Federal Reserve policy changes in coming months. Wall Street sees the Fed holding rates where they are for the summer, then making the first cut in the fall. Note: In the lower chart, the 4.6% probability of change is a 95.4% probability the rate will stay the same. Current rate is 4.25%-4.50%.

BUSINESS TIP OF THE WEEK

Write down clear goals for your business. Then break them down into the actionable steps it will take to achieve them—all the activities that drive your pipeline, from finding leads to closing deals. Above all, keep tracking your progress.

Kevin Brierton Branch Manager Certified Mortgage Planning Specialist NMLS# 599873

6991 East Camelback Rd., Ste D-300 Scottsdale, AZ 85251

Call or Text: 480-553-8770 kevin@kevinbrierton.com www.kevinbrierton.com