📉 Market Stability. Growing Inventory. Buyer Advantage?

QUOTE OF THE WEEK

“What’s the use of happiness? It can’t buy you money.”—Henny Youngman, English-born American comedian and musician

NATIONAL MARKET UPDATE

The Mortgage Bankers Association (MBA) reported “purchase applications were 20% ahead of last year’s pace, continuing to show strength” last week, as “homebuyers seem to be taking advantage of loosening housing inventory.”

The MBA also revealed that in May “credit supply increased to its highest level since August 2022…as lenders offered a greater variety of loan types to support the spring homebuying season.”

Cotality found home price growth in April was up just 2% year-over-year, “the lowest growth in more than a decade,” noting that improved supply is “helping keep softer price pressures for those looking to buy this spring.”

REVIEW OF LAST WEEK

FREAKY FRIDAY… After positive vibes surrounding tariffs and inflation kept markets resilient to profit-taking pressures, stocks could not avoid finishing lower Friday on concerns over an escalating conflict between Israel and Iran.

Continuing jobless claims rose to a level not seen in more than three years, indicating laid-off workers are having trouble finding new jobs quickly. Initial jobless claims also gained on the week, but are nowhere near recession levels.

Plus, Consumer Price Index (CPI) inflation came in lower than expected in May, the deficit is down almost 9% from a year ago, and the Small Business Optimism and Michigan Consumer Sentiment indexes were both on the rise.

The week ended with the Dow down 1.3%, to 42,198; the S&P 500 down 0.4%, to 5,997; and the Nasdaq down 0.6%, to 19.407.

Risk-off money went over to bonds, which ended up overall, the 30-Year UMBS 5.5% UP 0.10, to 99.11. Freddie Mac reported the national average 30-year fixed mortgage rate inched down again, noting “rate stability, improving inventory and slower house price growth are an encouraging combination.” Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Home price growth should keep softening. New data says there are now nearly half a million— over 33%—more sellers than buyers. A year ago, there were just 6.5% more sellers. Two years ago, buyers outnumbered sellers.

THIS WEEK’S FORECAST

HOME BUILDING, RETAIL SALES, THE FED… Analysts expect Housing Starts and Building Permits to edge down in May, as builders remain focused on completions to meet higher homebuyer demand. Retail Sales are also forecast to take a May breather. Wednesday’s FOMC Rate Decision should see the Fed keeping the rate on hold despite waning inflation.

FEDERAL RESERVE WATCH

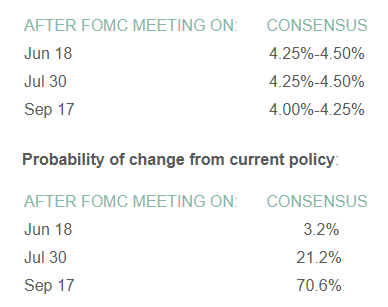

Forecasting Federal Reserve policy changes in coming months. Virtually no one on Wall St expects a rate cut from the Fed this week, but sentiment is growing for the first dip to come in September. Note: In the lower chart, the 3.2% probability of change is a 96.8% probability the rate will stay the same. Current rate is 4.25%-4.50%.

BUSINESS TIP OF THE WEEK

The most powerful asset you can develop in business—and life—is clarity of purpose—a solid certainty about why you do what you do, and who you are doing it for. You get results when you let your clarity of purpose—not other people, fear, or pressure—drive your decisions.

📞 Curious what these market shifts mean for your buying power or refinance options?Let’s schedule your Mortgage Strategy Call today — I’ll help you make sense of the numbers and find the right path forward.👉 kevinbrierton.com/call

Kevin Brierton Branch Manager Certified Mortgage Planning Specialist NMLS# 599873

6991 East Camelback Rd., Ste D-300 Scottsdale, AZ 85251

Call or Text: 480-553-8770 kevin@kevinbrierton.com www.kevinbrierton.com