Saturday Strategy

Mortgage FAQ's, did you knows and much more...

Is it better to reduce the price or apply money to a Temporary Seller Buydown option?

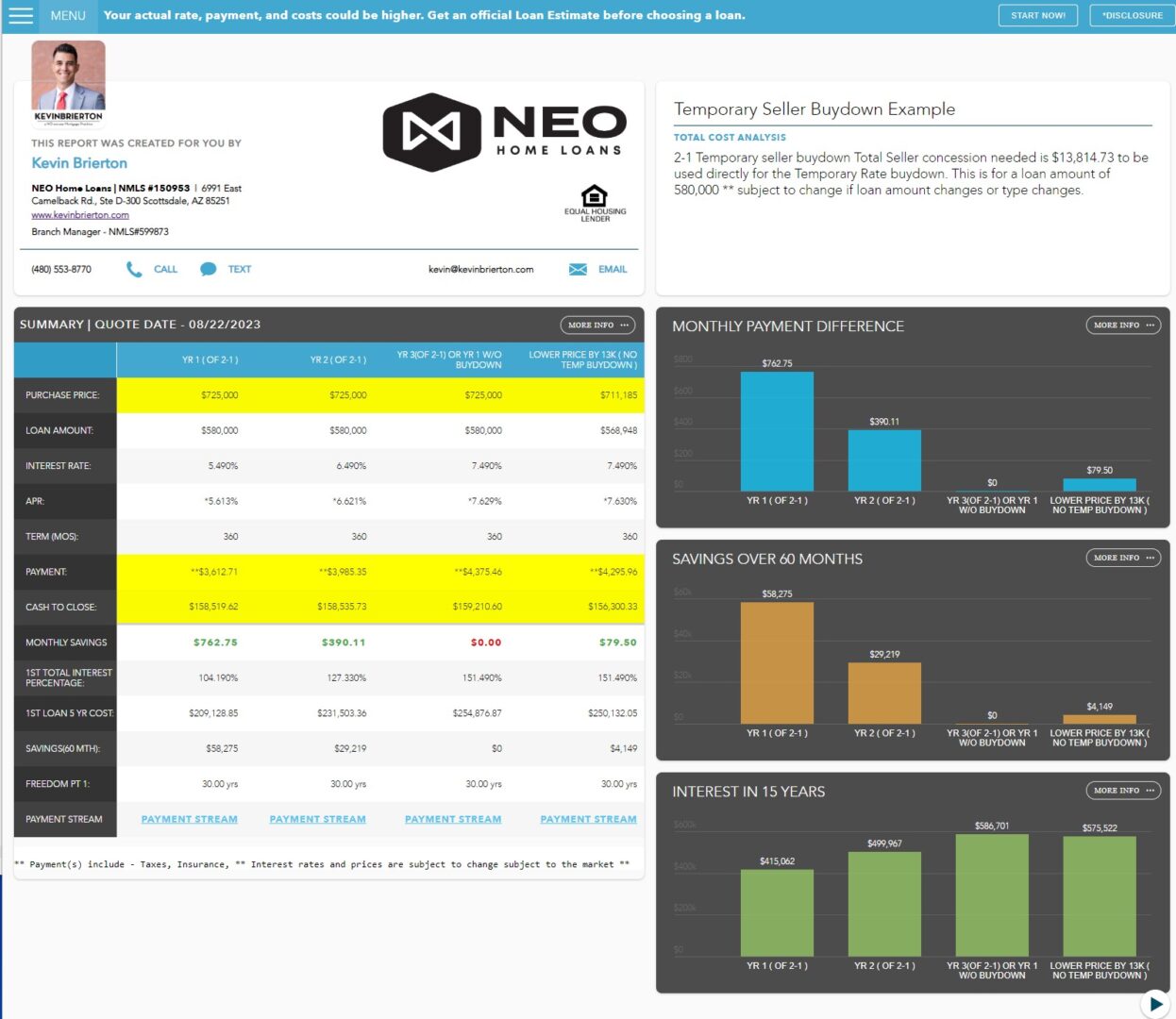

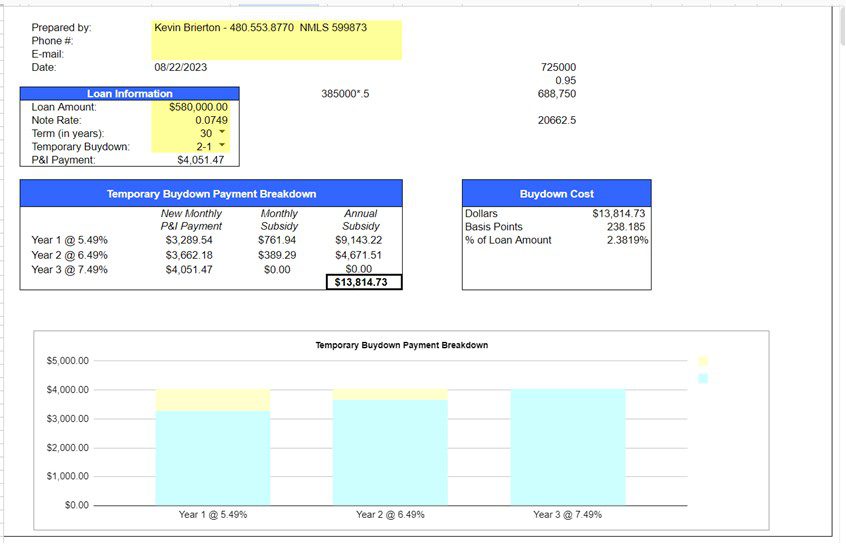

With rates and home prices at all time highs, I wanted to provide you with a clear understanding of the 2-1 Temporary Seller Buydown option, which can be a beneficial arrangement for both buyers and sellers in a real estate transaction.

In a 2-1 Temporary Seller Buydown, the seller agrees to contribute a certain amount of money upfront to reduce the interest rate on the buyer's mortgage loan for the first two years of the loan term. This results in lower monthly mortgage payments for the buyer during the initial years of homeownership.

Here's how it works:

- Seller Contribution: The seller allocates funds to the buyer's mortgage lender. This money is used to cover the interest rate reduction for the first two years.

- Interest Rate Reduction: The buyer's interest rate is temporarily "bought down" for the initial two years. This means the buyer pays a lower interest rate than the standard market rate during this period.

- Monthly Savings: As a result of the reduced interest rate, the buyer enjoys lower monthly mortgage payments during the first two years. This can make homeownership more affordable and manageable, especially during the early stages.

- Long-Term Benefits: While the seller buydown helps the buyer save money initially, it's important to note that the interest rate will gradually increase to the original market rate after the initial two-year period.

This arrangement can make a property more attractive to potential buyers, as it provides immediate financial relief during the crucial initial years of homeownership. For sellers, it can help expedite the sale of the property by offering a more competitive financing option.

P.S. Can I count on you to call us when any friends, family or coworkers are looking to buy, sell or refinance a home? We'd love to help! You can just text/call me at 480.553.8770. * Did you know we can finance in 45 states?

Here is an example of clear mortgage plan for a 2-1 Temporary Seller Buydown option

Planning To Sell Your House? It’s Critical To Hire a Pro.

Kevin Brierton – 12.29.2022 With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has changed and what that means for you. The best way to make sure you’re in the know is to work with…

What To Expect From the Housing Market in 2023

The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it’s put the market into a reset position. As the Federal Reserve (the Fed) made moves this year to try to lower inflation, mortgage rates more than doubled – something that’s never happened before in a calendar year. This…

Homeowners Still Have Positive Equity Gains over the Past 12 Months

If you’re a homeowner, your net worth got a big boost over the past few years thanks to rapidly rising home prices. Here’s how it happened and what it means for you, even as the market moderates. Equity is the current value of your home minus what you owe on the loan. Because there was…

Planning to Retire? It Could Be Time To Make a Move.

Kevin Brierton – 12.15.2022 If you’re thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs. Fortunately, you may be in a better position to make a move than you realize. Here are…

P.S. Can I count on you to contact me if you hear that a friend, family or coworker is looking to buy, sell or refinance? Call/Text 480.553.8770 - We'd be honored to help them too!