No, A ‘Housing Recession’ Does Not Mean Falling Home Prices

Kevin Brierton – 11.13.2023

Last week, an article was posted to fortune.com with this headline:

The housing market is headed back to a 1980s-style recession, Wells Fargo says—and it’s all because of ‘higher for longer’ mortgage rates

On first read, this clearly sounds like a warning that home prices are going to fall because of high mortgage rates. But if you actually read the article, you would find a different story:

The bank expects worsened affordability in the near term as mortgage rates remain elevated, which will in turn weaken housing activity. Home prices will continue to appreciate at a slightly slower pace because of underlying demand and tight supply, rising 1.8% by the end of this year, as tracked by Case-Shiller, and 2.5% in 2024. In 2025, Wells Fargo forecasts home prices will rise 4.4%.

The article even painted a positive picture of the near-term future of mortgage rates:

Assuming Wells Fargo’s forecast that the Fed has finished hiking interest rates and will lower them next year is accurate, mortgage rates should also move lower…The average 30-year fixed mortgage rate would finish off this year at 6.94%…Next year, the bank forecasts the average 30-year fixed mortgage rate will be 6.39%—and in 2025, it’ll sink lower still, to 5.70%.

So, headlines today sound like the housing market is heading into a massive recession, but mortgage rates are forecasted to go down and home prices are forecasted to go up. What gives?

Yes, we are experiencing a housing recession today, but it is not a recession of home PRICES – it is only a recession of ACTIVITY in the market.

Home prices and mortgage rates do not have an inverse relationship, as most people believe. Just look at history and you’ll see that it’s perfectly normal for home prices and interest rates to rise simultaneously. This is not a new phenomenon.

However, home sales definitely slow down when the cost of financing rises. That is the ‘housing recession’ we are experiencing today.

Why Home Prices Still Rise When Rates Are High

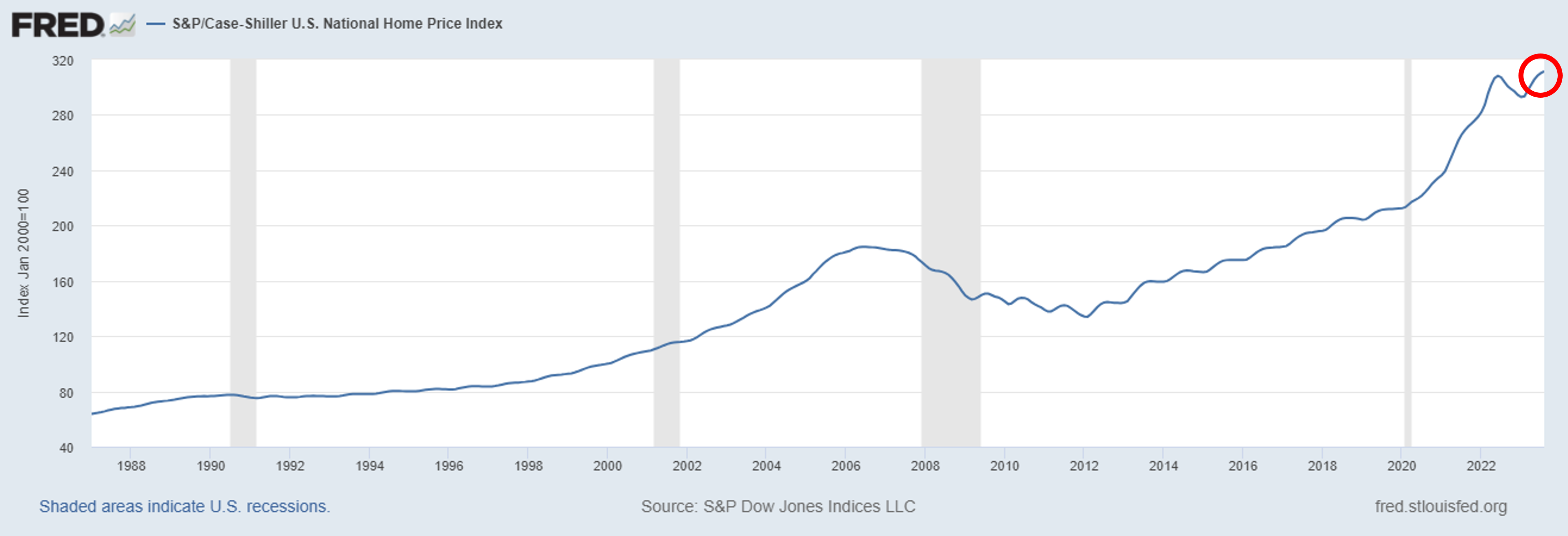

Even though mortgage rates are more than double what they were three years ago, home prices are still rising. According to the most recent CoreLogic Case-Shiller Index, prices rose 0.4% in August and were 2.6% higher than a year ago.

How could home prices outperform with mortgage rates rising?

More jobs and increased wages, combined with a low-interest rate environment, increased the money circulating in the economy and led to a lot more consumer spending and an increase in prices. Home prices were not immune to this.

Unfortunately, this also resulted in high inflation, which is why the Federal Reserve has raised its own policy rate 11 times since early last year.

Inflation has cooled significantly, and the Fed paused rate hikes in its meeting on November 1st, but this economic strength has coupled with the severe lack of for-sale inventory to propel home prices higher.

High Rates Severely Affect Homebuying Activity

On the other hand, when mortgage rates increase significantly, home sales tend to take a big hit.

This happens for obvious reasons, the main one being a lack of affordability. Fewer home buyers can qualify when financing costs are prohibitively high. Homebuyers may have seen their wages increase and they may have good jobs, but they are dealing with higher costs of living because of inflation. They have probably taken on a lot more debt, as well, so their debt-to-income ratios are not as favorable.

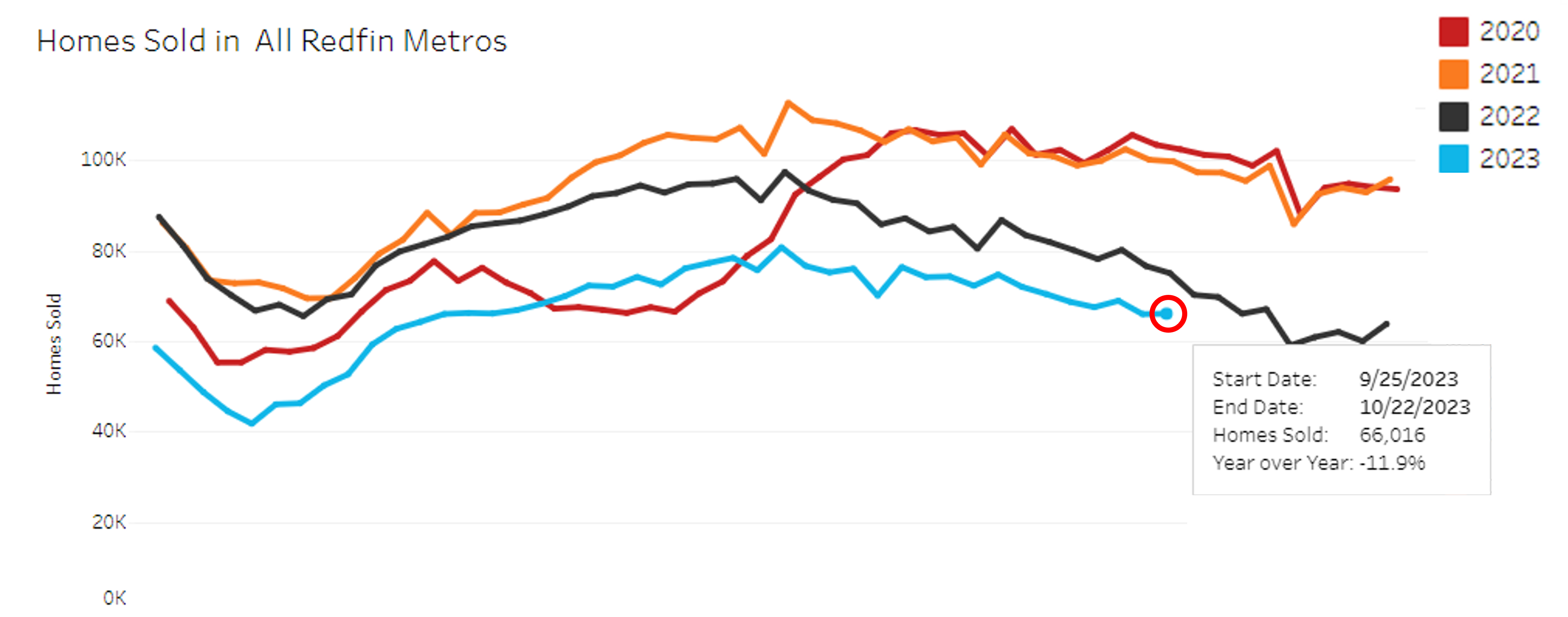

Per Redfin, current home sales are down 11.9% from this time last year and are now at their lowest sales pace since October 2010. For reference, in June of 2021, home sales hit their highest level since 2006.

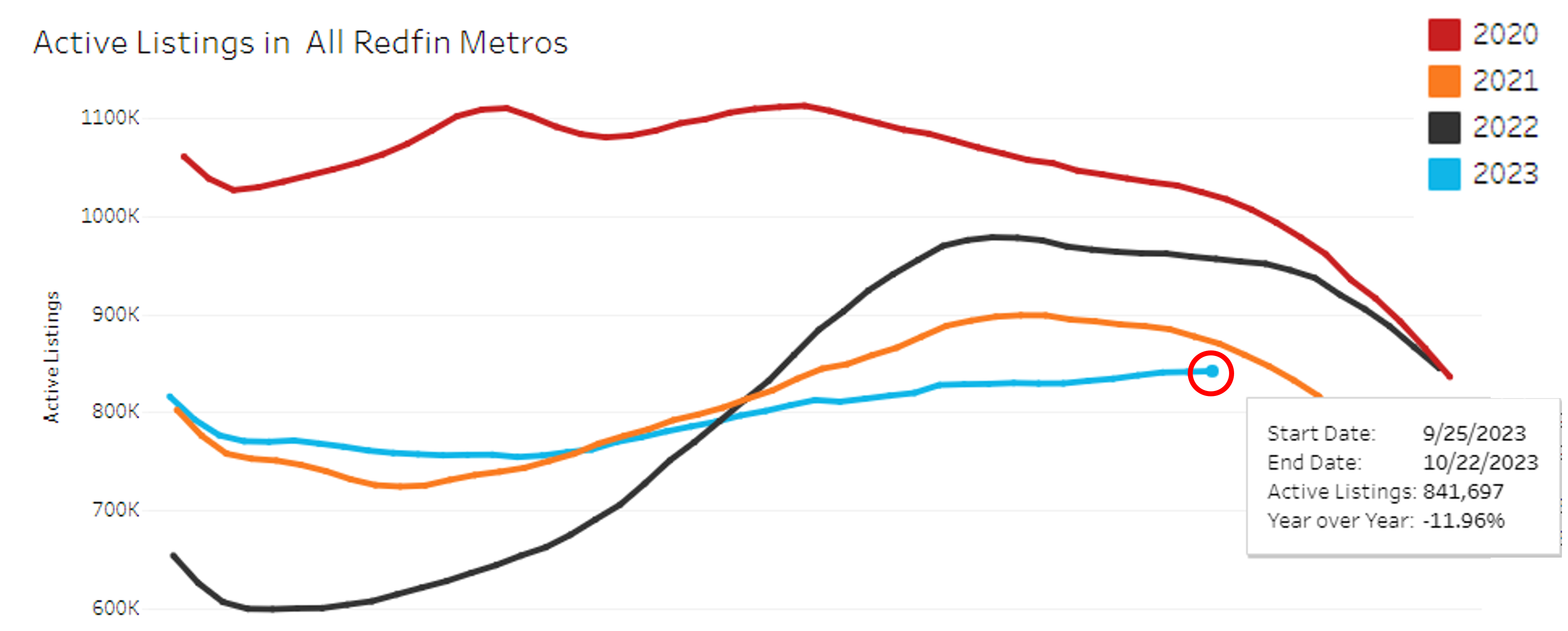

Meanwhile, the inventory of active listings has slowly been rising, but it is still down nearly 12% since this time last year.

But despite less demand and fewer buyers, the lower number of sales isn’t resulting in lower prices. Instead, we have a housing market with low demand and low supply and not a lot of budging from sellers on price.

Nobody is Selling, and There are Not Enough Homes Being Built

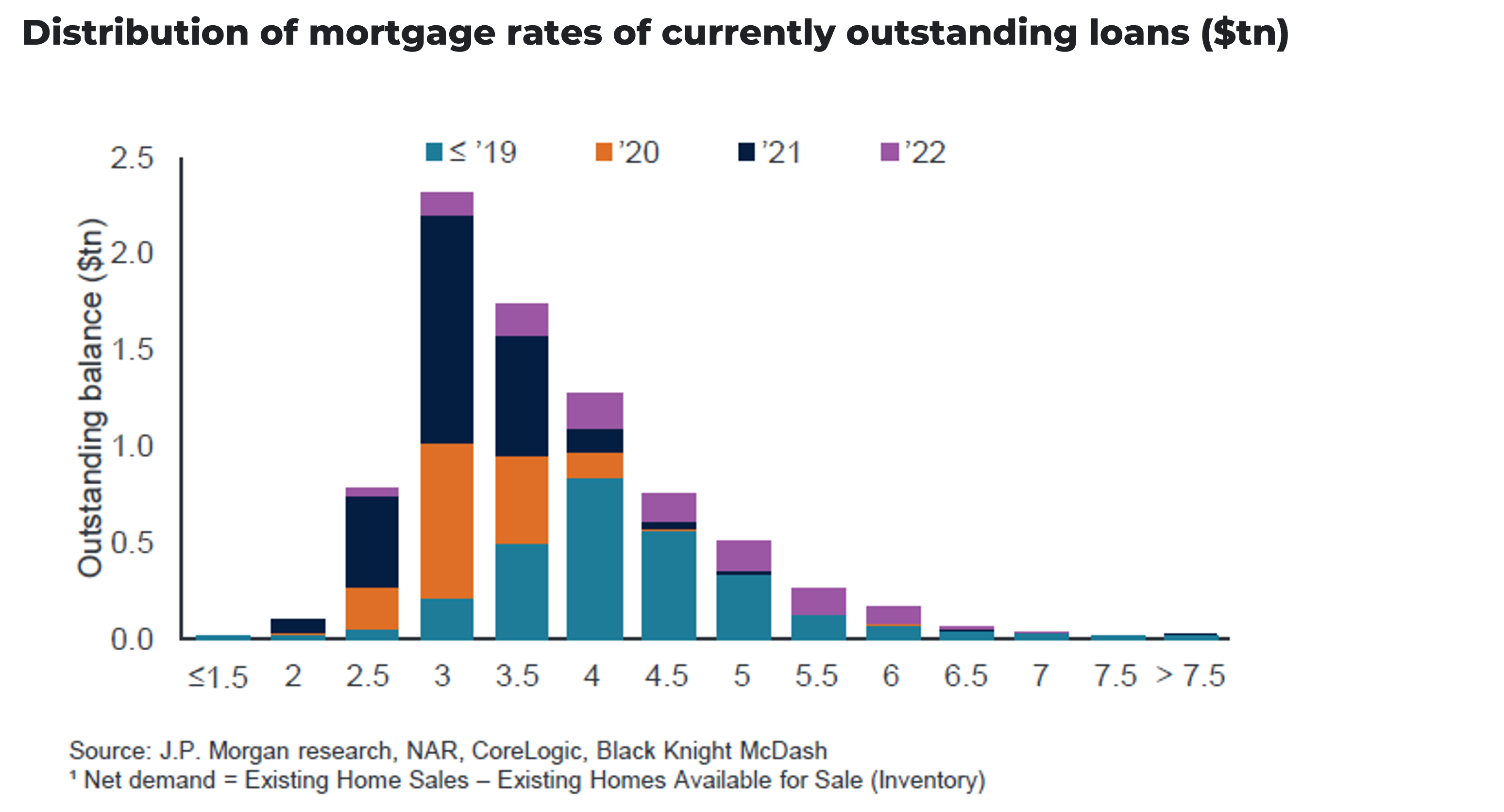

While there has been some debate about the mortgage rate lock-in effect, there’s no denying how strong of a force it is in today’s housing market when you look at the distribution of rates out there today.

Existing homeowners aren’t moving because their mortgage rates are so low. But it’s not only that they’re so low, it’s also the cost of replacement, with prevailing market rates now edging closer to 8%.

And this isn’t just a small number of homeowners. Nearly two-thirds of all mortgages out there today have an interest rate below 4%, and nearly a quarter have a rate below 3%. Most of these homeowners will not budge and will continue to enjoy their low, fixed-rate mortgage for many years to come.

Why would these owners ever want to sell? Why wouldn’t they rent out their homes and enjoy the cash flow from rents that have been pushed higher due to inflation while benefitting from their 30-year fixed mortgage rates that are well below the real rate of inflation?

In a new survey from Fannie Mae, researchers argued that even if mortgage rates were to decline by a meaningful amount in the intermediate term, they would not expect to see a big surge in for-sale listings. They believe there is a “confluence of factors and trends contributing to the lack of housing inventory in the United States.â€

Low-rate homeowners are keeping existing home supply out of the market, but builders are also having trouble bringing new homes to the market.

The Associated Builders and Contractors report that building material costs have increased by 37.7% since 2020. Since 2022, lumber has come down in price by 12.3%, while concrete products have increased by 14.8%.

Builders still face significant labor shortages, too. While there’s not a shortage of projects, there’s an increasing challenge to find qualified workers to complete these jobs. On top of that, construction equipment prices are up by 12.2% since 2022.

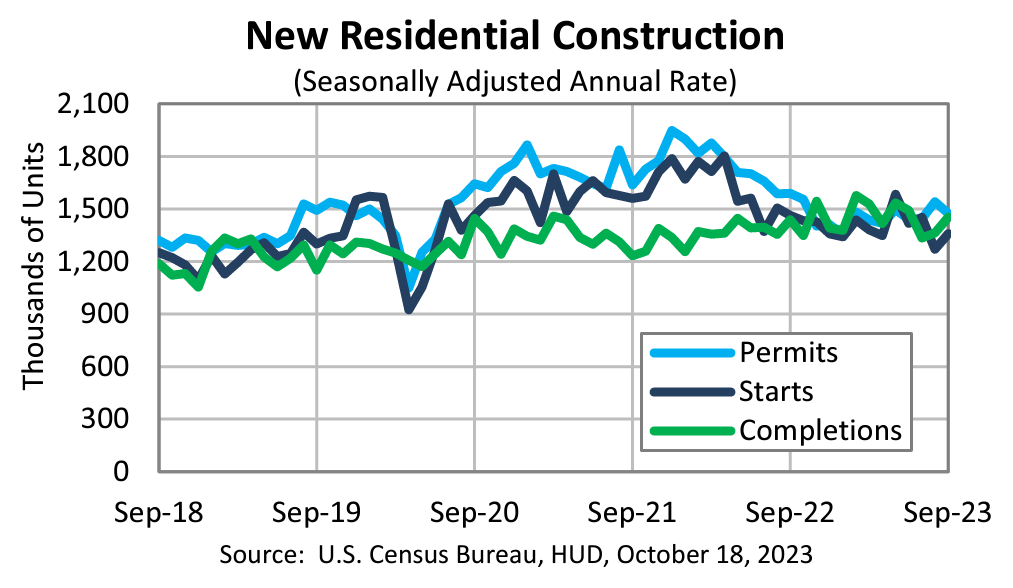

As you can see from the chart below from census.gov, housing permits and starts have fallen quite a bit since last year, and completions have remained relatively flat. If permits and starts are falling, we will start to see completions fall in the coming months, as well.

As the Economy Slows, Rates Will Come Down

The U.S. economy is heading for a recession. You might see a lot of stories about how strong the economy is and how likely it is that the Federal Reserve will achieve a “soft-landing†and bring down inflation without severely slowing down the economy, but there are just too many red flags right now that say otherwise.

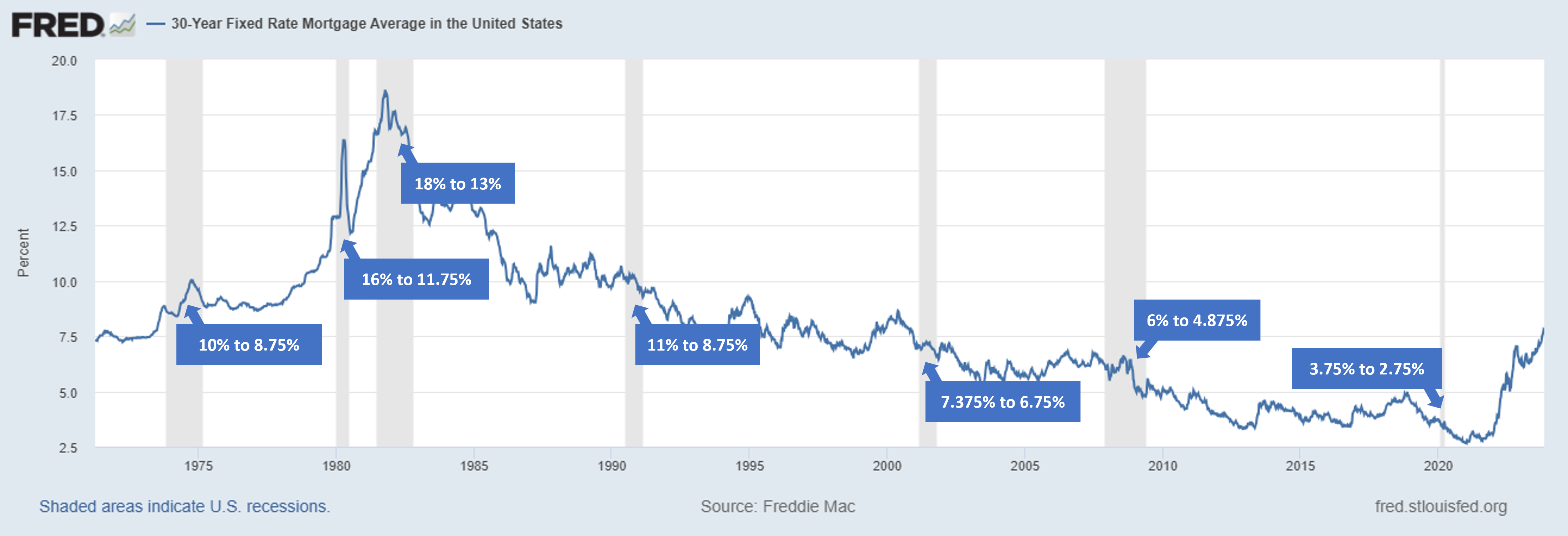

The chart below shows the average 30-year fixed-rate mortgage based on Freddie Mac data. The shaded portions are U.S. recessions.

The most recent recession was the COVID-19 recession which lasted from February to April of 2020. It was very short-lived, but it caused 30-year fixed mortgage rates to fall from 3.75% to their bottom of 2.75% in January 2021.

During the Great Recession, which spanned from December 2007 to June 2009, rates started around 6% and fell to roughly 4.875%. That recession was caused by the mortgage crisis, and the loose home loan lending collapsed the global financial system.

In the early 2000s recession, from March 2001 to November 2001, rates began at 7.375% and fell to 6.75%.

In the early 1990s recession, from July 1990 to March 1991, mortgage rates fell from around 11% to 8.75%.

The prior recession, from July 1981 to November 1982, saw rates plummet from the record high of 18% down to 13%.

And the 1980 recession from January 1980 to July 1980 saw rates move lower from 16% to 11.75%.

In all instances, mortgage rates went down during and immediately following the recession. And what will happen when rates come down? We agree with what real estate mogul Barbara Corcoran recently said:

The days of the 2 or 3% interest rates are never going to come again. Forget about that, but they will come down. The minute they drop and come down to anything with a five in front of it, the whole world is going to jump back into the market, there’s going to be no houses around and prices are going to go up by 10% or even 15% — so don’t get out of the market.

The Bottom Line

Home prices will continue rising over the long term like they always have. The home you want is going to be more expensive a year from now. Buying today means you will be able to lock in your home’s price before housing costs increase even more. If interest rates do go down as predicted, you can refinance to a permanently lower rate.

And remember, because interest rates are high right now, fewer people are buying. This means you won’t have as much competition when you make offers, and it’s likely you will have some negotiating power to secure a lower price or seller credits to reduce your costs even more.

We understand that everyone’s situation is different. Before making any decisions on your homebuying plans, it’s crucial that you look at the numbers for your specific purchase scenario and financial situation.

If you would like to know more about your options for purchasing a home today, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all your questions and create a detailed loan comparison so you can create a solution that is best suited to fit your needs.