FIVE THINGS THAT IMPACT YOUR CREDIT SCORES

HOW ARE CREDIT SCORES CALCULATED?

Your credit scores usually determine the price you pay for your money (mortgages, auto loans, auto leases, credit cards, business loans, etc.). Perhaps the most significant part of your credit report is your credit score. Credit scores range from 350 to 850, with 850 being the best possible credit score, and 350 being the worst possible credit score. There are three credit bureaus in the US that collect information about you from your creditors. These bureaus then calculate a credit score based on that information. This means that you have three credit scores, one issued by each of the three credit bureaus:

- Equifax

- Experian

- Transunion

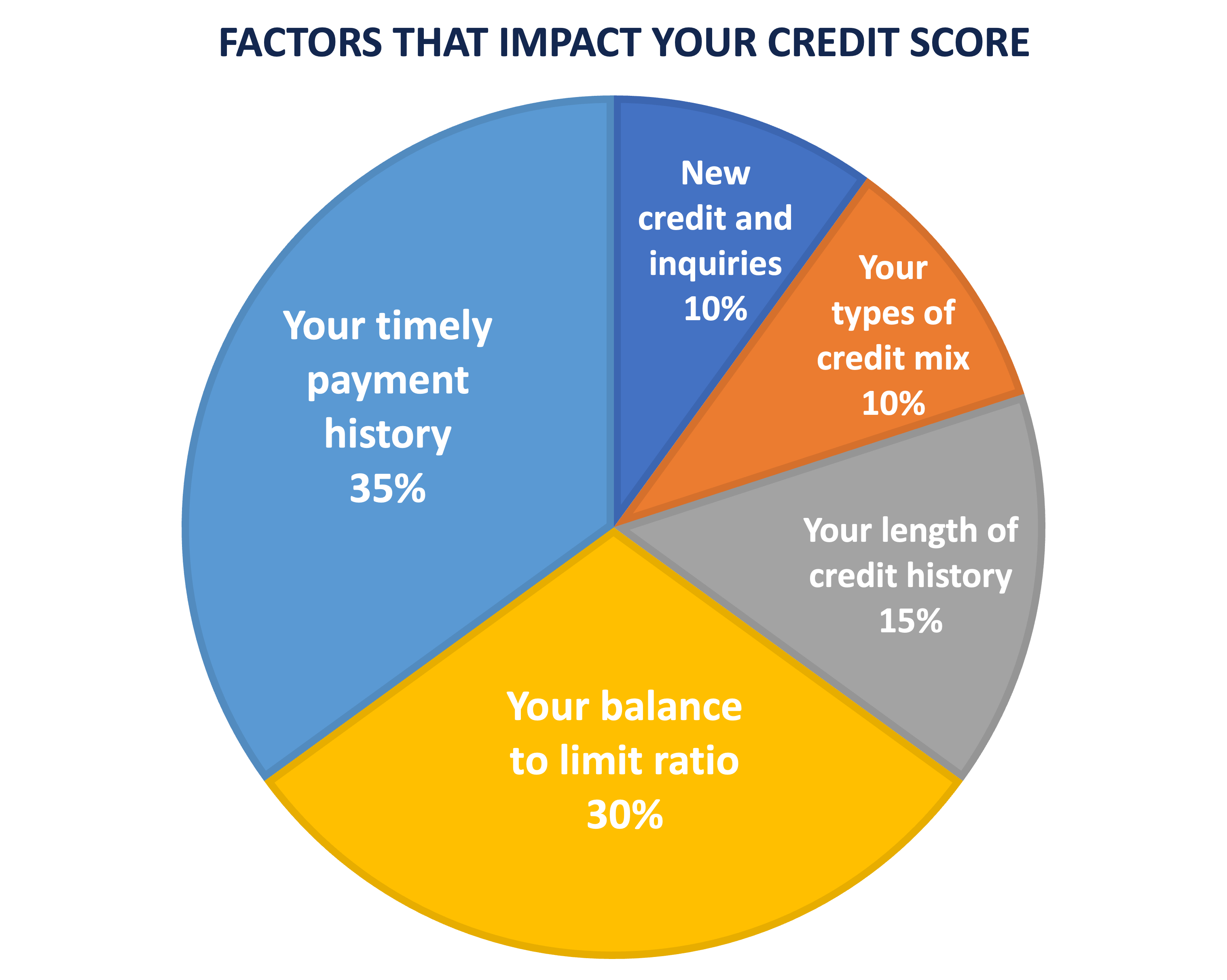

Mortgage lenders typically order a tri-merged credit report when you apply for a home loan. The tri-merged credit report gives the lender information from all three credit bureaus. The lender typically uses your middle credit score or the lowest of your three credit scores when they evaluate your loan application. These five factors determine your credit score:

1. YOUR TIMELY PAYMENT HISTORY

Do you pay your bills on time or do you have late payments? Your payment history has a 35% impact on your score.

2. YOUR BALANCE-TO-LIMIT RATIO

How much do you owe vs. your available credit lines? Your balance-to-limit ratio has a 30% impact on your score.

3. YOUR LENGTH OF CREDIT HISTORY

How long have your accounts been opened? Your length of credit history has a 15% impact on your score.

4. YOUR TYPES OF CREDIT MIX

What types of credit do you have open? This has a 10% impact on your score.

5. NEW CREDIT AND INQUIRIES

How many recent inquiries have been made by creditors? Your recent credit inquiries have a 10% impact on your score.

NUMBER OF THE WEEK

65%

THAT’S HOW MUCH YOUR PAYMENT HISTORY AND BALANCE-TO-LIMIT RATIO IMPACT YOUR CREDIT SCORE

Source: Momentifi